Answers: 2

Another question on Business

Business, 22.06.2019 17:10

Calculate riverside’s financial ratios for 2014. assume that riverside had $1,000,000 in lease payments and $1,400,000 in debt principal repayments in 2014. (hint: use the book discussion to identify the applicable ratios.)

Answers: 3

Business, 22.06.2019 22:20

Who owns a renter-occupied apartment? a. the government b. a landlord c. the resident d. a cooperative

Answers: 1

Business, 22.06.2019 23:10

Mr. pines is considering buying a house and renting it to students. the yearly operating costs are $1,900. the house can be sold for $175,000 at the end of 10 years and it is considered 18% to be a suitable annual effective interest rate. if the house costs $100,000 to purchase, how much would you need to charge your tenants each year in rent? (assume a single payment for the years rent at the end of each year)

Answers: 1

Business, 24.06.2019 00:30

Janice is a baby boomer, born in 1959. between the ages of 18 and 50, she held only five jobs. according to a study published by the bureau of labor statistics in 2015, janice's experience is below the job average for people born from 1957 to 1964, who held an average of jobs between the ages of 18 and 48.

Answers: 1

You know the right answer?

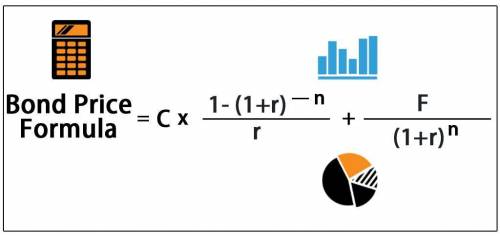

Gabriele Enterprises has bonds on the market making annual payments, with 18 years to maturity, a pa...

Questions

Social Studies, 03.12.2020 20:50

Mathematics, 03.12.2020 20:50

Mathematics, 03.12.2020 20:50

Biology, 03.12.2020 20:50

Chemistry, 03.12.2020 20:50

Mathematics, 03.12.2020 20:50

Health, 03.12.2020 20:50

Mathematics, 03.12.2020 21:00

Mathematics, 03.12.2020 21:00

English, 03.12.2020 21:00