Business, 25.08.2020 20:01 robert7248

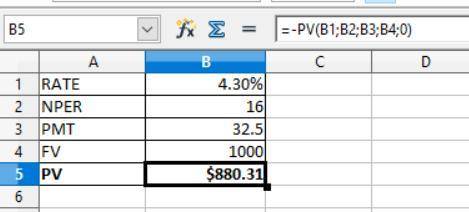

A company issues a ten-year bond at par with a coupon rate of 6.5% paid semi-annually. The YTM at the beginning of the third year of the bond (8 years left to maturity) is 8.6%. What is the new price of the bond

Answers: 3

Another question on Business

Business, 22.06.2019 20:00

If a government accumulates chronic budget deficits over time, what's one possible result? a. a collective action problem b. a debt crisis c. regulatory capture d. an unfunded liability

Answers: 2

Business, 22.06.2019 22:00

You wish to retire in 13 years, at which time you want to have accumulated enough money to receive an annual annuity of $23,000 for 18 years after retirement. during the period before retirement you can earn 9 percent annually, while after retirement you can earn 11 percent on your money. what annual contributions to the retirement fund will allow you to receive the $23,000 annuity? use appendix c and appendix d for an approximate answer, but calculate your final answer using the formula and financial calculator methods.

Answers: 1

Business, 23.06.2019 08:30

Ryan receives an e-mail that states the internet is being cleaned up and that he should leave his computer powered-off for 24 hours after receipt of this message. after careful review of the message contents and verifying the information with the desk he realizes this is:

Answers: 2

Business, 23.06.2019 08:40

One principle of usability testing is that it permeates product development. what does that mean?

Answers: 3

You know the right answer?

A company issues a ten-year bond at par with a coupon rate of 6.5% paid semi-annually. The YTM at th...

Questions

Mathematics, 20.10.2019 09:00

History, 20.10.2019 09:00

Mathematics, 20.10.2019 09:00

Mathematics, 20.10.2019 09:00

Chemistry, 20.10.2019 09:00

Chemistry, 20.10.2019 09:00

Mathematics, 20.10.2019 09:00

History, 20.10.2019 09:00

Mathematics, 20.10.2019 09:00