Business, 02.09.2020 04:01 natalie2sheffield

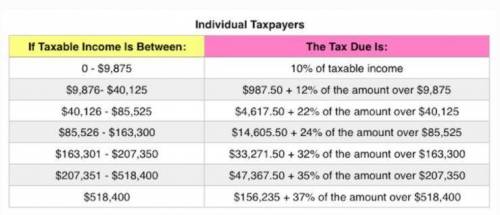

Chuck, a single taxpayer, earns $58,500 in taxable income and $20,800 in interest from an investment in City of Heflin bonds. (Use the U. S tax rate schedule.)Required: How much federal tax will he owe? What is his average tax rate? What is his effective tax rate? What is his current marginal tax rate?

Answers: 1

Another question on Business

Business, 22.06.2019 11:50

After graduation, you plan to work for dynamo corporation for 12 years and then start your own business. you expect to save and deposit $7,500 a year for the first 6 years (t = 1 through t = 6) and $15,000 annually for the following 6 years (t = 7 through t = 12). the first deposit will be made a year from today. in addition, your grandfather just gave you a $32,500 graduation gift which you will deposit immediately (t = 0). if the account earns 9% compounded annually, how much will you have when you start your business 12 years from now?

Answers: 1

Business, 23.06.2019 01:50

Describe two (2) financial career options that an individual with a finance education might pursue and explain the value that such a position adds to a company. explain the essential skills that would make a person successful in each of the described positions. recommend one (1) of the career options. identify the most attractive features of the position.

Answers: 2

Business, 23.06.2019 06:50

It is most important to account for factors like warranties and durability when purchasing durable goods or very expensive items

Answers: 1

You know the right answer?

Chuck, a single taxpayer, earns $58,500 in taxable income and $20,800 in interest from an investment...

Questions

English, 21.09.2019 00:00

English, 21.09.2019 00:00

Social Studies, 21.09.2019 00:00

Mathematics, 21.09.2019 00:00

Mathematics, 21.09.2019 00:00

History, 21.09.2019 00:00