Business, 03.09.2020 01:01 chaycebell74021

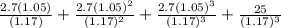

Davenport Corporation's last dividend was $2.70, and the directors expect to maintain the historic 3% annual rate of growth. You plan to purchase the stock today because you feel that the growth rate will increase to 5% for the next three years and the stock will then reach $25 per share.1. How much should you be willing to pay for the stock if you require a 17% return? 2. How much should you be willing to pay for the stock if yo feel that the 5% growth rate can be maintained indefinitely and you require a 17% return?

Answers: 2

Another question on Business

Business, 21.06.2019 20:30

What does the phrase limited liability mean in a corporate context?

Answers: 2

Business, 22.06.2019 16:00

What impact might an economic downturn have on a borrower’s fixed-rate mortgage? a. it might cause a borrower’s payments to go up. b. it might cause a borrower’s payments to go down. c. it has no impact because a fixed-rate mortgage cannot change. d. it has no impact because the economy does not affect interest rates.

Answers: 1

Business, 22.06.2019 17:20

“strategy, plans, and budgets are unrelated to one another.” do you agree? explain. explain how the manager’s choice of the type of responsibility center (cost, revenue, profit, or investment) affects the behavior of other employees.

Answers: 3

Business, 22.06.2019 17:30

Which of the following services will be provided by a full-service broker but not by a discount broker? i. research of potential investment opportunities ii. purchase and sale of stock at your request iii. recommendation of investments a. i and iii b. ii only c. iii only d. i, ii, and ii

Answers: 2

You know the right answer?

Davenport Corporation's last dividend was $2.70, and the directors expect to maintain the historic 3...

Questions

Biology, 27.09.2019 00:50

English, 27.09.2019 00:50

Mathematics, 27.09.2019 00:50

Biology, 27.09.2019 00:50

History, 27.09.2019 00:50

History, 27.09.2019 00:50

History, 27.09.2019 00:50

Mathematics, 27.09.2019 00:50

Mathematics, 27.09.2019 00:50

Chemistry, 27.09.2019 00:50

Mathematics, 27.09.2019 00:50

Mathematics, 27.09.2019 00:50

Mathematics, 27.09.2019 00:50