Business, 08.10.2020 09:01 Turtlelover05

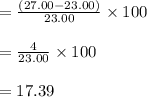

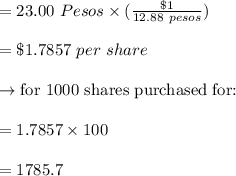

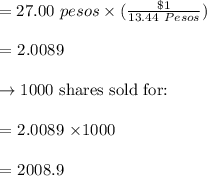

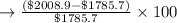

International investment returns Personal Finance Problem Joe Martinez, a U. S. citizen living in Brownsville, Texas, invested in the common stock of Telmex, a Mexican corporation. He purchased 1 comma 000 shares at 23.00 pesos per share. Twelve months later, he sold them at 27.00 pesos per share. He received no dividends during that time. a. What was Joe's investment return (in percentage terms) for the year, on the basis of the peso value of the shares? b. The exchange rate for pesos was 12.88 pesos per US$1.00 at the time of the purchase. At the time of the sale, the exchange rate was 13.44 pesos per US$1.00. Translate the purchase and sale prices into US$. c. Calculate Joe's investment return on the basis of the US$ value of the shares. d. Explain why the two returns are different. Which one is more important to Joe? Why?

Answers: 2

Another question on Business

Business, 21.06.2019 17:40

Sodas in a can are supposed to contain an average of 12 ounces. this particular brand has a standard deviation of 0.1 ounces, with an average of 12.1 ounces. if the can's contents follow a normal distribution, what is the probability that the mean contents of a six pack are less than 12 ounces?

Answers: 2

Business, 22.06.2019 16:10

Regarding the results of a swot analysis, organizational weaknesses are (a) internal factors that the organization may exploit for a competitive advantage (b) internal factors that the organization needs to fix in order to be competitive (c) mbo skills that should be emphasized (d) skills and capabilities that give an industry advantages problems that a specific industry needs to correct

Answers: 1

Business, 22.06.2019 17:30

Costco wholesale corporation operates membership warehouses selling food, appliances, consumer electronics, apparel and other household goods at 471 locations across the u.s. as well as in canada, mexico and puerto rico. as of its fiscal year-end 2005, costco had approximately 21.2 million members. selected fiscal-year information from the company's balance sheets follows. ($ millions). selected balance sheet data 2005 2004 merchandise inventories $4,015 $3,644 deferred membership income (liability) 501 454 (a) during fiscal 2005, costco collected $1,120 cash for membership fees. use the financial statement effectstemplate to record the cash collected for membership fees. (b) in 2005, costco recorded $46,347 million in merchandise costs (that is, cost of goods sold). record thistransaction in the financial statement effects template. (c) determine the value of merchandise that costco purchased during fiscal-year 2005. use the financial statementeffects template to record these merchandise purchases. assume all of costco's purchases are on credit.

Answers: 3

Business, 22.06.2019 17:50

The management of a supermarket wants to adopt a new promotional policy of giving a free gift to every customer who spends > a certain amount per visit at this supermarket. the expectation of the management is that after this promotional policy is advertised, the expenditures for all customers at this supermarket will be normally distributed with a mean of $95 and a standard deviation of $20. if the management wants to give free gifts to at most 10% of the customers, what should the amount be above which a customer would receive a free gift?

Answers: 1

You know the right answer?

International investment returns Personal Finance Problem Joe Martinez, a U. S. citizen living in Br...

Questions

English, 29.11.2019 04:31