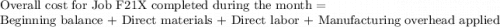

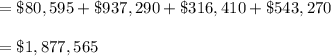

Zander Inc. uses a job-order costing system in which any underapplied or overapplied overhead is closed to cost of goods sold at the end of the month. In July the company completed job F21X that consisted of 29,850 units of one of the company's standard products. No other jobs were in process during the month. The job cost sheet for job F21X shows the following costs: Beginning balance $80,595 Direct materials $937,290 Direct labor cost $316,410 Manufacturing overhead cost applied $543,270 During the month, the actual manufacturing overhead cost incurred was $537,300 and 19,900 completed units from job F21X were sold. No other products were sold during the month. The unadjusted cost of goods sold (in other words, the cost of goods sold BEFORE adjustment for any underapplied or overapplied overhead) for July is closest to:.

Answers: 2

Another question on Business

Business, 21.06.2019 16:20

Winston uses the high-low method. it had an average cost per unit of $10 at its lowest level of activity when sales equaled 10,000 units and an average cost per unit of $6.50 at its highest level of activity when sales equaled 20,000 units. what would winston estimate its total cost to be if sales equaled 8,000 units?

Answers: 3

Business, 21.06.2019 19:50

The u.s. stock market has returned an average of about 9% per year since 1900. this return works out to a real return (i.e., adjusted for inflation) of approximately 6% per year. if you invest $100,000 and you earn 6% a year on it, how much real purchasing power will you have in 30 years?

Answers: 2

Business, 21.06.2019 23:30

On september 12, ryan company sold merchandise in the amount of $5,800 to johnson company, with credit terms of 2/10, n/30. the cost of the items sold is $4,000. ryan uses the periodic inventory system and the net method of accounting for sales. on september 14, johnson returns some of the non-defective merchandise, which is restored to inventory. the selling price of the returned merchandise is $500 and the cost of the merchandise returned is $350. the entry or entries that ryan must make on september 14 is (are): multiple choice sales returns and allowances 490 accounts receivable 490 merchandise inventory 350 cost of goods sold 350 sales returns and allowances 490 accounts receivable 490 sales returns and allowances 500 accounts receivable 500 sales returns and allowances 490 accounts receivable 490 merchandise inventory 343 cost of goods sold 343 sales returns and allowances 350 accounts receivable 350

Answers: 1

Business, 22.06.2019 07:40

(a) what was the opportunity cost of non-gm food for many buyers before 2008? (b) why did they prefer the alternative? (c) what was the opportunity cost in 2008? (d) why did it change?

Answers: 3

You know the right answer?

Zander Inc. uses a job-order costing system in which any underapplied or overapplied overhead is clo...

Questions

Social Studies, 04.08.2019 22:30

History, 04.08.2019 22:30

Chemistry, 04.08.2019 22:30

Mathematics, 04.08.2019 22:30

Advanced Placement (AP), 04.08.2019 22:30

History, 04.08.2019 22:30

Biology, 04.08.2019 22:30

Business, 04.08.2019 22:30

Health, 04.08.2019 22:30

Mathematics, 04.08.2019 22:30

Mathematics, 04.08.2019 22:30

Physics, 04.08.2019 22:30

per unit

per unit