Business, 13.10.2020 06:01 heatherballiet866

Forest Components makes aircraft parts. The following transactions occurred in July.

1. Purchased $119,000 of materials on account.

2. Issued $117,600 in direct materials to the production department.

3. Issued $8,400 of supplies from the materials inventory.

4. Direct labor employees earned $217,000, which was paid in cash.

5. Purchased miscellaneous items for the manufacturing plant for $120,400 on account.

6. Recognized depreciation on manufacturing plant of $245,000.

7. Applied manufacturing overhead for the month.

8. Job X that cost $533,000 was completed.

9. Some units in Job X, that cost $521,500, were sold for $800,000 cash.

10. After all of the previous transactions posted, the Manufacturing overhead control account shows a debit balance of $373,800, and the Applied manufacturing overhead account shows a credit balance of $201,800. The over- or under-applied overhead was closed to Cost of goods sold. Forest uses normal costing. It applies overhead on the basis of direct labor costs using an annual, predetermined rate. At the beginning of the year, management estimated that direct labor costs for the year would be $3,000,000. Estimated overhead for the year was $2,790,000.

Required:

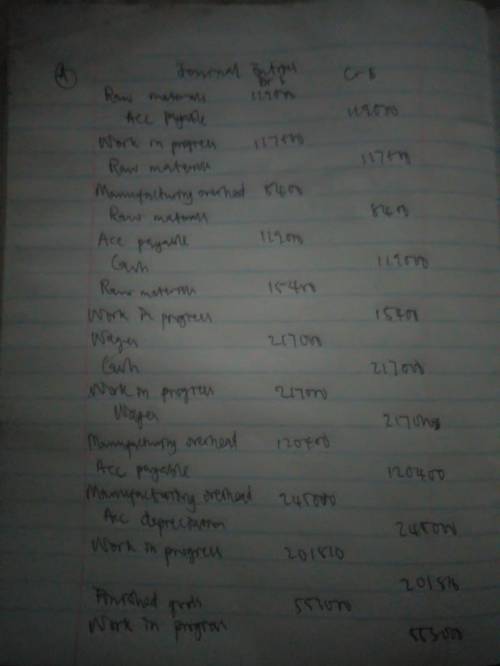

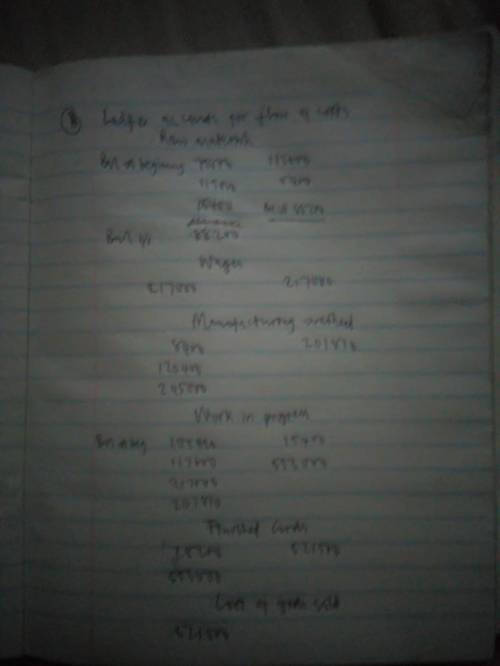

a. Prepare T-accounts to show the flow of costs during the period from Materials Inventory through Cost of Goods Sold.

b. Prepare journal entries to record these transactions.

Answers: 2

Another question on Business

Business, 22.06.2019 03:30

Diversified semiconductors sells perishable electronic components. some must be shipped and stored in reusable protective containers. customers pay a deposit for each container received. the deposit is equal to the container’s cost. they receive a refund when the container is returned. during 2018, deposits collected on containers shipped were $856,000. deposits are forfeited if containers are not returned within 18 months. containers held by customers at january 1, 2018, represented deposits of $587,000. in 2018, $811,000 was refunded and deposits forfeited were $41,000. required: 1. prepare the appropriate journal entries for the deposits received and returned during 2018. 2. determine the liability for refundable deposits to be reported on the december 31, 2018, balance sheet.

Answers: 1

Business, 22.06.2019 11:00

When using various forms of promotion to carry the promotion message, it is important that the recipients of the message interpret it in the same way. creating a unified promotional message, where potential customers perceive the same message, whether it is in a tv commercial, or on a billboard, or in a blog, is called

Answers: 2

You know the right answer?

Forest Components makes aircraft parts. The following transactions occurred in July.

1. Purchased $...

Questions

Mathematics, 14.07.2019 01:30

Health, 14.07.2019 01:30

Mathematics, 14.07.2019 01:30

English, 14.07.2019 01:30

Mathematics, 14.07.2019 01:30

History, 14.07.2019 01:30

Mathematics, 14.07.2019 01:30

Biology, 14.07.2019 01:30

Mathematics, 14.07.2019 01:30

Computers and Technology, 14.07.2019 01:30