Business, 15.10.2020 07:01 andrespiperderc

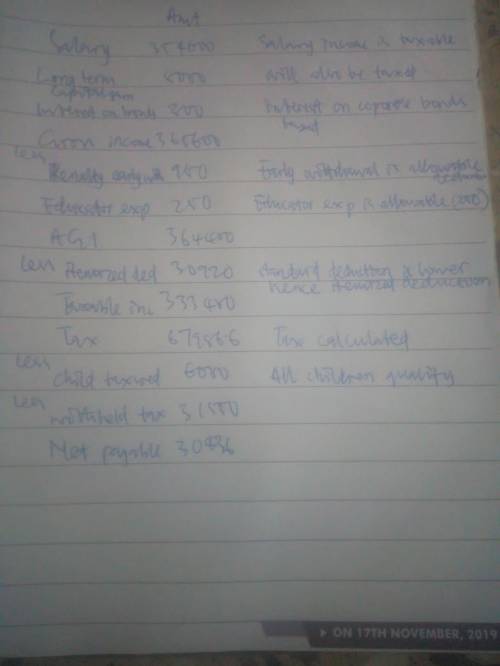

Han and Leia Solo have been married for 24 years and have three children who qualify as their dependents (Jacen, 4; Jaina, 14; and Ben, 16). The couple received salary income of $354,600. They sold some stock they had owned for 4 years and had an $8,000 gain on the sale. They also received $3,000 of corporate bond interest and $6,400 of interest from Jabba City bonds. The Soloâs also cashed in a Certificate of Deposit early during the year and paid a $950 penalty on the early withdrawal. Additionally, Han (who teaches middle school) spent $875 on supplies and snacks for his classroom. The Solos accumulated $30,920 of itemized deductions and they had $31,550 withheld from their paychecks for federal income taxes.

a. gross income

b. deductions for AGI

c. adjusted gross income

d. standard deduction

e. itemized deductions

f. taxable income

g. tax liability

Required:

Use the table below to show what you did and did not include in Gross Income, Deductions and/or other items and your explanation. Feel free to add additional rows as necessary.

Item amount explanation

Answers: 2

Another question on Business

Business, 21.06.2019 18:00

You want to make an investment in a continuously compounding account over a period of two years. what interest rate is required for your investment to double in that time period? round the logarithm value and the answer to the nearest tenth.

Answers: 3

Business, 22.06.2019 12:10

Lambert manufacturing has $100,000 to invest in either project a or project b. the following data are available on these projects (ignore income taxes.): project a project b cost of equipment needed now $100,000 $60,000 working capital investment needed now - $40,000 annual cash operating inflows $40,000 $35,000 salvage value of equipment in 6 years $10,000 - both projects will have a useful life of 6 years and the total cost approach to net present value analysis. at the end of 6 years, the working capital investment will be released for use elsewhere. lambert's required rate of return is 14%. the net present value of project b is:

Answers: 2

Business, 22.06.2019 21:10

Which of the following statements is (are) true? i. free entry to a perfectly competitive industry results in the industry's firms earning zero economic profit in the long run, except for the most efficient producers, who may earn economic rent. ii. in a perfectly competitive market, long-run equilibrium is characterized by lmc < p < latc. iii. if a competitive industry is in long-run equilibrium, a decrease in demand causes firms to earn negative profit because the market price will fall below average total cost.

Answers: 3

Business, 22.06.2019 23:30

What are consequences of rapid inflation? (select all that apply.) savings accounts become less desirable because interest earned is lower than inflation individual purchasing power increases, which results in an increase in demand. individual purchasing power decreases, which results in a decrease in demand. people postpone purchasing expensive items, such as homes, until prices drop.

Answers: 1

You know the right answer?

Han and Leia Solo have been married for 24 years and have three children who qualify as their depend...

Questions

History, 24.08.2019 18:10

Biology, 24.08.2019 18:10

Biology, 24.08.2019 18:10