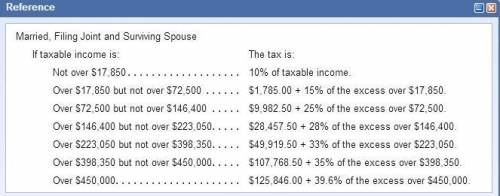

Jill and George are married and file a joint return. They expect to have $410,000 of taxable income in the next year and are considering whether to purchase a personal residence that would provide additional tax deductions of $80.000 for mortgage interest and real estate taxes.

Not over $17,850 10% of taxable income.

Over $17,850 but not over $72,500 $1,78500 + 15% of the excess over $17,850.

Over $72,500 but not over $146,400 $9,982.50 + 25% of the excess over $72,500.

Over $146,400 but not over $223,050 $28,45780 + of the excess over $146,400.

Over $223,050 but not over $398,350 S49,919S0 + of the excess over $223,050.

Over $398,350 but not over $450,000 $107,76840 + of the excess over $398,350.

Over $450,000 $125,846ff + 39.6 of the excess over $450,000.

Required:

a. What is their marginal tax rate for purposes of making this decision?

b. What is the tax savings if the residence is acquired?

Answers: 3

Another question on Business

Business, 21.06.2019 20:30

Abond is issued for less than its face value. which statement most likely would explain why? a. the bond's contract rate is higher than the market rate at the time of the issue. b. the bond's contract rate is the same as the market rate at the time of the issue. c. the bond's contract rate is lower than the market rate at the time of the issue. d. the bond isn't secured by specific assets of the corporation.

Answers: 1

Business, 22.06.2019 13:50

Read the following paragraph, and choose the best revision for one of its sentences.dr. blake is retiring at the end of the month. there will be an unoccupied office upon his departure, and it is big in size. because every other office is occupied, we should convert dr. blake’s office into a lounge. it is absolutely essential that this issue is discussed at the next staff meeting. (a) because every other office is occupied, it’s recommended that we should convert dr. blake’s office into a lounge. (b) because every other office is filled, we should convert dr. blake’s office into a lounge.

Answers: 2

Business, 22.06.2019 20:00

Ajax corp's sales last year were $435,000, its operating costs were $362,500, and its interest charges were $12,500. what was the firm's times-interest-earned (tie) ratio? a. 4.72b. 4.97c. 5.23d. 5.51e. 5.80

Answers: 1

Business, 22.06.2019 20:40

Owns a machine that can produce two specialized products. production time for product tlx is two units per hour and for product mtv is four units per hour. the machine’s capacity is 2,100 hours per year. both products are sold to a single customer who has agreed to buy all of the company’s output up to a maximum of 3,570 units of product tlx and 1,610 units of product mtv. selling prices and variable costs per unit to produce the products follow. product tlx product mtv selling price per unit $ 11.50 $ 6.90 variable costs per unit 3.45 4.14 determine the company's most profitable sales mix and the contribution margin that results from that sales mix.

Answers: 3

You know the right answer?

Jill and George are married and file a joint return. They expect to have $410,000 of taxable income...

Questions

Mathematics, 10.12.2019 06:31

Mathematics, 10.12.2019 06:31

Mathematics, 10.12.2019 06:31

Mathematics, 10.12.2019 06:31

Mathematics, 10.12.2019 06:31

Physics, 10.12.2019 06:31

Mathematics, 10.12.2019 06:31

English, 10.12.2019 06:31

Mathematics, 10.12.2019 06:31