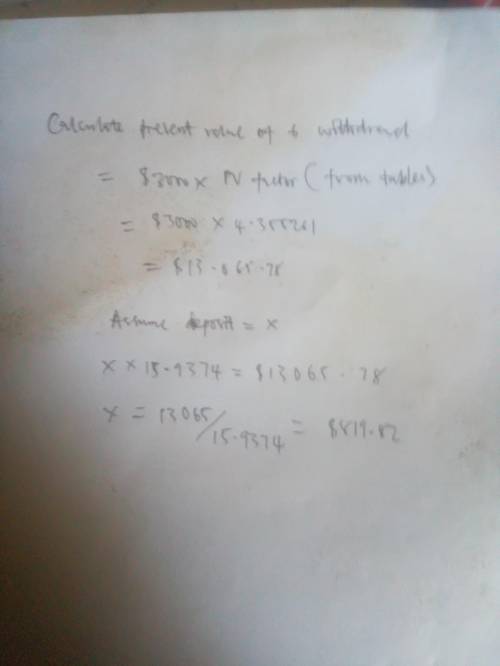

Amount of an Annuity John Goodheart wishes to provide for 6 annual withdrawals of $3,000 each beginning January 1, 2029. He wishes to make 10 annual deposits beginning January 1, 2019, with the last deposit to be made on January 1, 2028. Required: If the fund earns interest compounded annually at 10%, how much is each of the 10 deposits

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

Long-distance providers are becoming increasingly concerned about certain activities within their industry. various companies come together voluntarily to implement new standards of social responsibility that members must abide by. what seems to be the primary motivation in this case for an increased interest in social responsibility? - because corporations are creations of society, they are responsible for giving back to the communities in which they operate.- these companies have realized it is in their best interest to increase their social responsibility before they are once again subject to stricter regulations.- these companies are using social responsibility as a means to increase their profitability, both short term and long term.- long-distance providers have started taking pride in their industry and its record for social responsibility.- they feel a responsibility to their stockholders, employees, the government, investors, and society as a whole.

Answers: 2

Business, 22.06.2019 11:00

%of the world's population controls approximately % of the world's finances (the sum of gross domestic products)" quizlket

Answers: 1

Business, 22.06.2019 18:00

Large public water and sewer companies often become monopolies because they benefit from although the company faces high start-up costs, the firm experiences average production costs as it expands and adds more customers. smaller competitors would experience average costs and would be less

Answers: 1

Business, 22.06.2019 19:00

Tri fecta, a partnership, had revenues of $369,000 in its first year of operations. the partnership has not collected on $45,000 of its sales and still owes $39,500 on $155,000 of merchandise it purchased. there was no inventory on hand at the end of the year. the partnership paid $27,000 in salaries. the partners invested $48,000 in the business and $23,000 was borrowed on a five-year note. the partnership paid $2,070 in interest that was the amount owed for the year and paid $9,500 for a two-year insurance policy on the first day of business. compute net income for the first year for tri fecta.

Answers: 2

You know the right answer?

Amount of an Annuity John Goodheart wishes to provide for 6 annual withdrawals of $3,000 each beginn...

Questions

Physics, 31.01.2020 05:01

English, 31.01.2020 05:01

History, 31.01.2020 05:01

Mathematics, 31.01.2020 05:01

Physics, 31.01.2020 05:01

Mathematics, 31.01.2020 05:01

History, 31.01.2020 05:01

Mathematics, 31.01.2020 05:01

Mathematics, 31.01.2020 05:01

Computers and Technology, 31.01.2020 05:01

Spanish, 31.01.2020 05:01