Business, 17.10.2020 20:01 twistedgamerhd12

Case Inc. is a construction company specializing in custom patios. The patios are constructed of concrete, brick, fiberglass, and lumber, depending upon customer preference. On June 1, 2017, the general ledger for Case Inc. contains the following data.

Raw Materials Inventory $4,200 Manufacturing Overhead Applied $32,640

Work in Process Inventory $5,540 Manufacturing Overhead Incurred $31,650

Subsidiary data for Work in Process Inventory on June 1 are as follows.

Job Cost Sheets

Customer Job

Cost Element Rodgers Stevens Linton

Direct materials $600 $800 $900

Direct labor 320 540 580

Manufacturing overhead 400 675 725

$1,320 $2,015 $2,205

During June, raw materials purchased on account were $4,900, and all wages were paid. Additional overhead costs consisted of depreciation on equipment $900 and miscellaneous costs of $400 incurred on account.

A summary of materials requisition slips and time tickets for June shows the following.

Customer Job Materials Requisition Slips Time Tickets

Rodgers $800 $850

Koss 2,000 800

Stevens 500 360

Linton 1,300 1,200

Rodgers 300 390

4,900 3,600

General use 1,500 1,200

$6,400 $4,800

Overhead was charged to jobs at the same rate of $1.25 per dollar of direct labor cost. The patios for customers Rodgers, Stevens, and Linton were completed during June and sold for a total of $18,900. Each customer paid in full.

Instructions

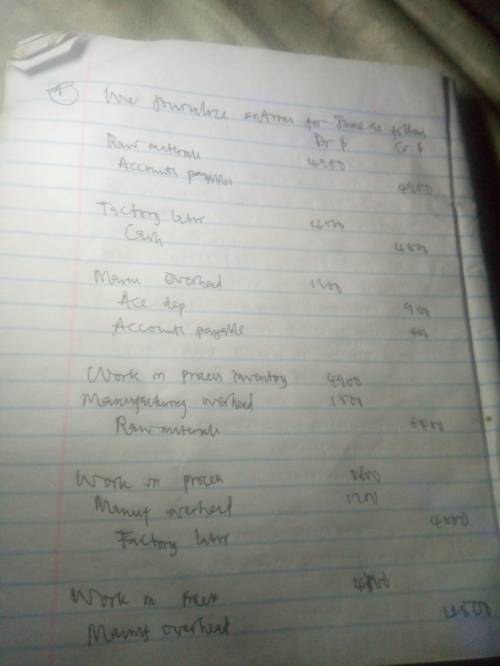

Journalize the June transactions: (1) for purchase of raw materials, factory labor costs incurred, and manufacturing overhead cost incurred; (2) assignment of direct materials, labor, and overhead to production; and (3) completion of jobs and sale of goods.

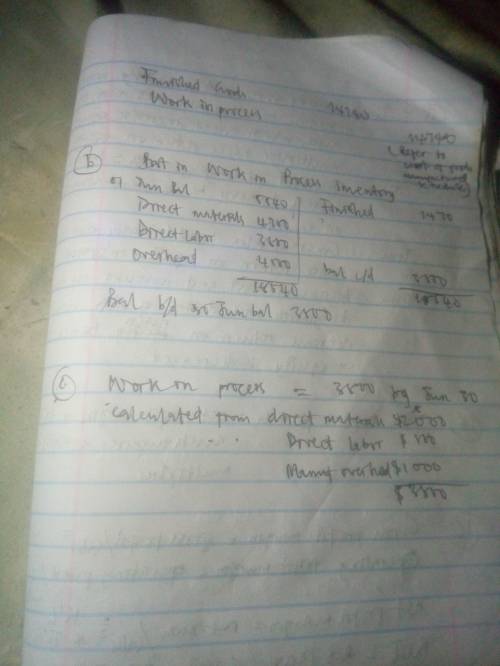

Post the entries to Work in Process Inventory.

Reconcile the balance in Work in Process Inventory with the costs of unfinished jobs.

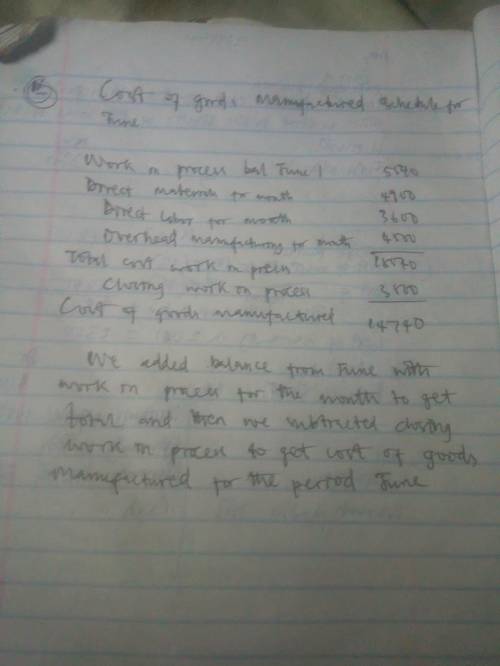

Prepare a cost of goods manufactured schedule for June.

Answers: 3

Another question on Business

Business, 21.06.2019 19:30

Henry crouch's law office has traditionally ordered ink refills 7070 units at a time. the firm estimates that carrying cost is 4545% of the $1212 unit cost and that annual demand is about 245245 units per year. the assumptions of the basic eoq model are thought to apply. for what value of ordering cost would its action be optimal? a) for what value of ordering cost would its action be optimal? its action would be optimal given an ordering cost of $nothing per order (round your response to two decimal place

Answers: 3

Business, 22.06.2019 10:20

Asmartphone manufacturing company uses social media to achieve different business objectives. match each social media activity of the company to the objective it the company achieve.

Answers: 3

Business, 22.06.2019 11:10

Wilson company paid $5,000 for a 4-month insurance premium in advance on november 1, with coverage beginning on that date. the balance in the prepaid insurance account before adjustment at the end of the year is $5,000, and no adjustments had been made previously. the adjusting entry required on december 31 is: (a) debit cash. $5,000: credit prepaid insurance. $5,000. (b) debit prepaid insurance. $2,500: credit insurance expense. $2500. (c) debit prepaid insurance. $1250: credit insurance expense. $1250. (d) debit insurance expense. $1250: credit prepaid insurance. $1250. (e) debit insurance expense. $2500: credit prepaid insurance. $2500.

Answers: 1

You know the right answer?

Case Inc. is a construction company specializing in custom patios. The patios are constructed of con...

Questions

Mathematics, 20.03.2021 07:30

Biology, 20.03.2021 07:30

Mathematics, 20.03.2021 07:30

Mathematics, 20.03.2021 07:30

Biology, 20.03.2021 07:30

Mathematics, 20.03.2021 07:30

World Languages, 20.03.2021 07:30

Mathematics, 20.03.2021 07:30

Mathematics, 20.03.2021 07:30

Engineering, 20.03.2021 07:30