Actual Amount

Monthly Budget

Budgeted Amount

$1000

$850

Income

Wages<...

Business, 20.10.2020 05:01 vvkaitlynvv4982

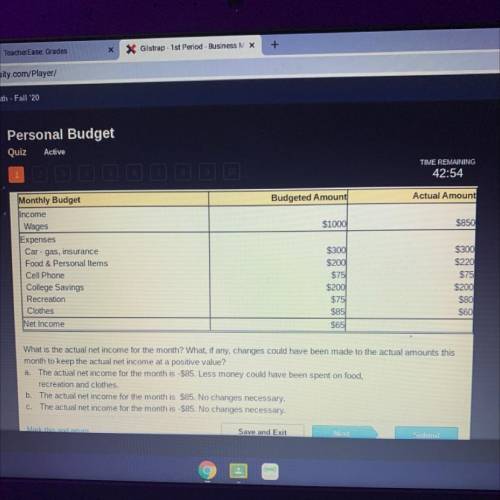

Actual Amount

Monthly Budget

Budgeted Amount

$1000

$850

Income

Wages

Expenses

Car - gas, insurance

Food & Personal Items

Cell Phone

College Savings

Recreation

Clothes

Net Income

$300

$200

$75

$200

$75

$85

$65

$300

$220

$75

$200

$80

$60

What is the actual net income for the month? What, if any, changes could have been made to the actual amounts this

month to keep the actual net income at a positive value?

a. The actual net income for the month is -$85. Less money could have been spent on food,

recreation and clothes.

b. The actual net income for the month is $85. No changes necessary.

c. The actual net income for the month is -$85. No changes necessary.

The actual net income for the month is 095 Lace monaw. could have hean cnant on food

d

Answers: 1

Another question on Business

Business, 22.06.2019 20:50

Happy foods and general grains both produce similar puffed rice breakfast cereals. for both companies, thecost of producing a box of cereal is 45 cents, and it is not possible for either company to lower their productioncosts any further. how can one company achieve a competitive advantage over the other?

Answers: 1

Business, 23.06.2019 03:00

In each of the cases below, assume division x has a product that can be sold either to outside customers or to division y of the same company for use in its production process. the managers of the divisions are evaluated based on their divisional profits. case a b division x: capacity in units 200,000 200,000 number of units being sold to outside customers 200,000 160,000 selling price per unit to outside customers $ 90 $ 75 variable costs per unit $ 70 $ 60 fixed costs per unit (based on capacity) $ 13 $ 8 division y: number of units needed for production 40,000 40,000 purchase price per unit now being paid to an outside supplier $ 86 $ 74 required: 1. refer to the data in case a above. assume in this case that $3 per unit in variable selling costs can be avoided on intracompany sales. a. what is the lowest acceptable transfer price from the perspective of the selling division? b. what is the highest acceptable transfer price from the perspective of the buying division? c. what is the range of acceptable transfer prices (if any) between the two divisions? if the managers are free to negotiate and make decisions on their own, will a transfer probably take place?

Answers: 3

Business, 23.06.2019 16:30

Consider the following potential events that might have occurred to global on december​ 30, 2016. for each​ one, indicate which line items in​ global's balance sheet would be affected and by how much. also indicate the change to​ global's book value of equity. a. global used $ 19.8$19.8 million of its available cash to repay $ 19.8$19.8 million of its​ long-term debt. b. a warehouse fire destroyed $ 4.9$4.9 million worth of uninsured inventory. c. global used $ 4.6$4.6 million in cash and $ 5.1$5.1 million in new​ long-term debt to purchase a $ 9.7$9.7 million building. d. a large customer owing $ 3.2$3.2 million for products it already received declared​ bankruptcy, leaving no possibility that global would ever receive payment. e. ​global's engineers discover a new manufacturing process that will cut the cost of its flagship product by more than 48 %48%. f. a key competitor announces a radical new pricing policy that will drastically undercut​ global's prices.

Answers: 2

You know the right answer?

Questions

Mathematics, 21.08.2019 08:00

Social Studies, 21.08.2019 08:00

History, 21.08.2019 08:00

Geography, 21.08.2019 08:00

Social Studies, 21.08.2019 08:00

Physics, 21.08.2019 08:00

Health, 21.08.2019 08:00

History, 21.08.2019 08:00

Biology, 21.08.2019 08:00