Business, 20.10.2020 16:01 kprincess16r

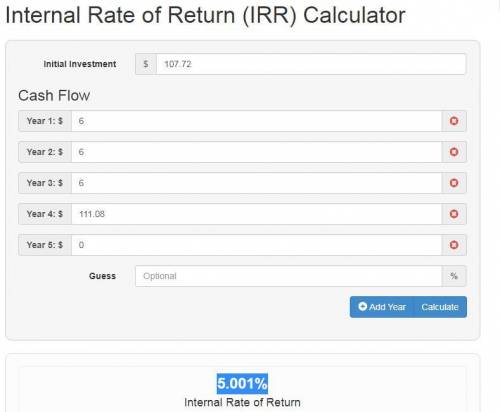

Suppose you purchase a ten-year bond with annual coupons. You hold the bond for four years and sell it immediately after receiving the fourth coupon. If the bond's yield to maturity was when you purchased and sold the bond, a. What cash flows will you pay and receive from your investment in the bond per face value? b. What is the internal rate of return of your investment?

Answers: 2

Another question on Business

Business, 21.06.2019 21:40

Forecasting as a first step in the team’s decision making, it wants to forecast quarterly demand for each of the two types of containers for years 6 to 8. based on historical trends, demand is expected to continue to grow until year 8, after which it is expected to plateau. julie must select the appropriate forecasting method and estimate the likely forecast error. which method should she choose? why? using the method selected, forecast demand for years 6 to 8.

Answers: 2

Business, 22.06.2019 21:10

Upon completion of the northwest-corner rule, which source-destination cell is guaranteed to be occupied? a. top-leftb. the cell with the lowest shipping costc. bottom-leftd. top-righte. bottom-right

Answers: 1

Business, 22.06.2019 21:50

Labor unions have used which of the following to win passage of favorable laws such as shorter work weeks and the minimum wage? a. strikes b. collective bargaining c. lobbying d. lockouts

Answers: 1

You know the right answer?

Suppose you purchase a ten-year bond with annual coupons. You hold the bond for four years and sell...

Questions

Mathematics, 18.03.2021 02:20

Mathematics, 18.03.2021 02:20

Spanish, 18.03.2021 02:20

Mathematics, 18.03.2021 02:20

Mathematics, 18.03.2021 02:20

Mathematics, 18.03.2021 02:20

Business, 18.03.2021 02:20

English, 18.03.2021 02:20

Mathematics, 18.03.2021 02:20

Mathematics, 18.03.2021 02:20