Business, 20.10.2020 16:01 ashley110608

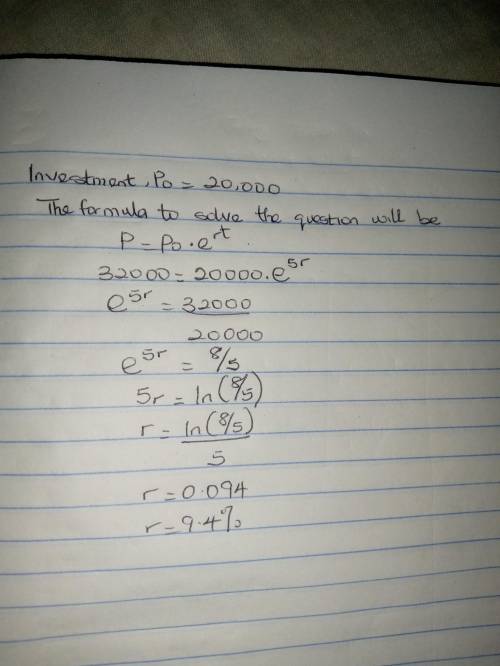

An investor buys 100 shares of a stock for $20,000. After 5 years the stock is sold for $32,000. If interest is compounded continuously, what annual nominal rate of interest did the original $20,000 investment earn? Round the final answer to the nearest hundredth.

Answers: 3

Another question on Business

Business, 21.06.2019 19:20

The following selected amounts are reported on the year-end unadjusted trial balance report for a company that uses the percent of sales method to determine its bad debts expense. accounts receivable $ 435,000 debit allowance for doubtful accounts 1,250 debit net sales 2,100,000 credit all sales are made on credit. based on past experience, the company estimates 1.0% of credit sales to be uncollectible. what adjusting entry should the company make at the end of the current year to record its estimated bad debts expense

Answers: 2

Business, 22.06.2019 06:40

At april 1, 2019, the food and drug administration is in the process of investigating allegations of false marketing claims by hulkly muscle supplements. the fda has not yet proposed a penalty assessment. hulkly’s fiscal year ends on december 31, 2018. the company’s financial statements are issued in april 2019. required: for each of the following scenarios, determine the appropriate way to report the situation. 1. management feels an assessment is reasonably possible, and if an assessment is made an unfavorable settlement of $13 million is reasonably possible. 2. management feels an assessment is reasonably possible, and if an assessment is made an unfavorable settlement of $13 million is probable. 3. management feels an assessment is probable, and if an assessment is made an unfavorable settlement of $13 million is reasonably possible. 4. management feels an assessment is probable, and if an assessment is made an unfavorable settlement of $13 million is probable.

Answers: 1

Business, 22.06.2019 15:40

As sales exceed the break‑even point, a high contribution‑margin percentage (a) increases profits faster than does a low contribution-margin percentage (b) increases profits at the same rate as a low contribution-margin percentage (c) decreases profits at the same rate as a low contribution-margin percentage (d) increases profits slower than does a low contribution-margin percentage

Answers: 1

Business, 22.06.2019 17:00

You hold a diversified $100,000 portfolio consisting of 20 stocks with $5,000 invested in each. the portfolio's beta is 1.12. you plan to sell a stock with b = 0.90 and use the proceeds to buy a new stock with b = 1.50. what will the portfolio's new beta be? do not round your intermediate calculations.

Answers: 2

You know the right answer?

An investor buys 100 shares of a stock for $20,000. After 5 years the stock is sold for $32,000. If...

Questions

English, 23.02.2021 01:00

Mathematics, 23.02.2021 01:00

Mathematics, 23.02.2021 01:00

Advanced Placement (AP), 23.02.2021 01:00

Mathematics, 23.02.2021 01:00

Mathematics, 23.02.2021 01:00

Mathematics, 23.02.2021 01:00

Health, 23.02.2021 01:00

Mathematics, 23.02.2021 01:00

Mathematics, 23.02.2021 01:00

History, 23.02.2021 01:00