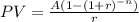

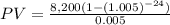

Problem 5-35 Comparing Cash Flow Streams [LO 1] You’ve just joined the investment banking firm of Dewey, Cheatum, and Howe. They’ve offered you two different salary arrangements. You can have $8,200 per month for the next two years, or you can have $6,900 per month for the next two years, along with a $37,000 signing bonus today. Assume the interest rate is 6 percent compounded monthly. Requirement 1: If you take the first option, $8,200 per month for two years, what is the present value? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e. g., 32.16).) Present value $ 139912.93 Requirement 2: What is the present value of the second option?

Answers: 3

Another question on Business

Business, 22.06.2019 11:50

What is marketing’s contribution to the new product development team? a. technical expertise needed to translate designs into an actual product/service. b. deep customer insight that leads to product ideas. c. ability to assess financial viability d. feedback on design as well as how customers will actually use the product e. technical expertise needed to translate concepts into product/service designs.

Answers: 2

Business, 22.06.2019 17:50

Which of the following is an element of inventory holding costs? a. material handling costs b. investment costs c. housing costs d. pilferage, scrap, and obsolescence e. all of the above are elements of inventory holding costs.

Answers: 1

Business, 22.06.2019 19:00

Consider the following information on stocks a, b, c and their returns (in decimals) in each state: state prob. of state a b c boom 20% 0.27 0.22 0.16 good 45% 0.16 0.09 0.07 poor 25% 0.03 0 0.03 bust 10% -0.08 -0.04 -0.02 if your portfolio is invested 25% in a, 40% in b, and 35% in c, what is the standard deviation of the portfolio in percent? answer to two decimals, carry intermediate calcs. to at least four decimals.

Answers: 2

Business, 22.06.2019 19:20

Why is following an unrelated diversification strategy especially advantageous in an emerging economy? a. it allows the conglomerate to overcome institutional weaknesses in emerging economies. b. it allows the conglomerate to form a monopoly in emerging economies. c. it allows the conglomerate to use well-defined legal systems in emerging economies. d. it allows the conglomerate to take advantage of strong capital markets in emerging economies.

Answers: 1

You know the right answer?

Problem 5-35 Comparing Cash Flow Streams [LO 1] You’ve just joined the investment banking firm of De...

Questions

Chemistry, 27.01.2021 23:50

History, 27.01.2021 23:50

Advanced Placement (AP), 27.01.2021 23:50

Business, 27.01.2021 23:50

Mathematics, 27.01.2021 23:50

Physics, 27.01.2021 23:50

Geography, 27.01.2021 23:50

Mathematics, 27.01.2021 23:50

Mathematics, 27.01.2021 23:50

Social Studies, 27.01.2021 23:50

Chemistry, 27.01.2021 23:50

Mathematics, 27.01.2021 23:50

= $185,015.50.

= $185,015.50. = $155,683.78 + $37,000 = $192,683.78.

= $155,683.78 + $37,000 = $192,683.78.