Business, 21.10.2020 16:01 isabelibarra6370

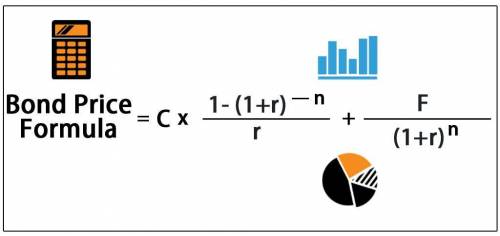

Both Bond Bill and Bond Ted have 5.8 percent coupons, make semiannual payments,

and are priced at par value. Bond Bill has 5 years to maturity, whereas Bond Ted has 25

years to maturity

a. If interest rates suddenly rise by 2 percent, what is the percentage change in the price

of these bonds? (A negative answer should be indicated by a minus sign. Do not

round intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e. g., 32.16.)

b. If rates were to suddenly fall by 2 percent instead, what would be the percentage

change in the price of these bonds? (Do not round intermediate calculations and

enter your answers as a percent rounded to 2 decimal places, e. g., 32.16.)

Answers: 1

Another question on Business

Business, 22.06.2019 02:00

Precision dyes is analyzing two machines to determine which one it should purchase. the company requires a rate of return of 15 percent and uses straight-line depreciation to a zero book value over the life of its equipment. ignore bonus depreciation. machine a has a cost of $462,000, annual aftertax cash outflows of $46,200, and a four-year life. machine b costs $898,000, has annual aftertax cash outflows of $16,500, and has a seven-year life. whichever machine is purchased will be replaced at the end of its useful life. which machine should the company purchase and how much less is that machine's eac as compared to the other machine's

Answers: 3

Business, 22.06.2019 06:40

After the 2008 recession, the amount of reserves in the us banking system increased. because of federal reserve actions, required reserves increased from $44 billion to $60 billion. however, banks started holding more reserves than required. by january 2009, banks were holding $900 billion in excess reserves. the federal reserve started paying interest on the excess reserves that the banks held. what possible impact will these unused reserves have on the economy?

Answers: 1

Business, 22.06.2019 09:00

Harry is 25 years old with a 1.55 rating factor for his auto insurance. if his annual base premium is $1,012, what is his total premium? $1,568.60 $2,530 $1,582.55 $1,842.25

Answers: 3

Business, 22.06.2019 20:50

Lead time for one of your fastest-moving products is 20 days. demand during this period averages 90 units per day.a) what would be an appropriate reorder point? ) how does your answer change if demand during lead time doubles? ) how does your answer change if demand during lead time drops in half?

Answers: 1

You know the right answer?

Both Bond Bill and Bond Ted have 5.8 percent coupons, make semiannual payments,

and are priced at p...

Questions

Biology, 25.09.2020 23:01

English, 25.09.2020 23:01

History, 25.09.2020 23:01

Mathematics, 25.09.2020 23:01

Mathematics, 25.09.2020 23:01

Computers and Technology, 25.09.2020 23:01

Mathematics, 25.09.2020 23:01

Mathematics, 25.09.2020 23:01

Law, 25.09.2020 23:01

Health, 25.09.2020 23:01