Business, 22.10.2020 01:01 skincarewithcourtney

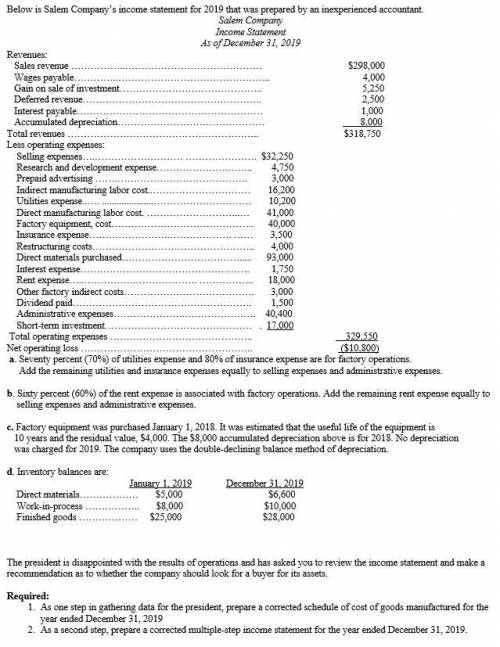

Below is Salem Company’s income statement for 2018 that was prepared by an inexperienced accountant. Salem Company Income Statement As of December 31, 2018 Revenues: Sales revenue ……………..…………………………………… $298,000 Wages payable…………..……………………………………….. 4,000 Gain on sale of investment…………………………………….. 5,250 Deferred revenue………………………………………………. 2,500 Interest payable………………………………………………… 1,000 Accumulated depreciation……………………………………… 10,000 Total revenues ………………………………………………….. $320,750 Less operating expenses: Selling expenses….……………………… …………………. $32,250 Research and development expense………………….…….. 4,750 Prepaid advertising …….…………………………………. 3,000 Indirect manufacturing labor cost..………………………… 16,200 Utilities expense..…. .………………………… 10,200 Direct manufacturing labor cost. ………………………..… 41,000 Factory equipment………………………………………….. 40,000 Insurance expense…………………….………………. …… 3,500 Restructuring costs………………………………………….. 4,000 Direct materials purchased………………………………. 93,000 Interest expense……………………………………………. 1,750 Rent expense…..…………….………………. …………….. 18,000 Other factory indirect costs…………………………………. 3,000 Dividend paid………………………………………………. 1,500 Administrative expenses………………….…………………. 40,400 Short-term investment……………………………………… . 19,000 Total operating expenses …………………………………….. 331,550 Net operating loss …………………………………………….. ($10,800) a. Seventy percent (70%) of utilities expense and 80% of insurance expense are for factory operations. Apply the remaining utilities and insurance expenses equally to selling expense and administrative expenses. b. Sixty percent (60%) of the rent expense is associated with factory operations. Allocate the remaining rent equally to selling expense and administrative expenses. c. Factory equipment was purchased January 1, 2017. It was estimated that the useful life of the equipment is 10 years and the residual value, $4,000. The $10,000 accumulated depreciation above is for 2017. No depreciation was charged for 2018. The company uses the double-declining balance method of depreciation. d. Inventory balances are: January 1, 2018 December 31, 2018 Direct materials……………… $5,000 $6,600 Work-in-process …………….. $8,000 $10,000 Finished goods ……………… $25,000 $28,000 e. The company’s tax rate is 21%. The president is disappointed with the results of operations and has asked you to review the income statement and make a recommendation as to whether the company should look for a buyer for its assets. Required: 1. As one step in gathering data for the president, prepare a corrected schedule of cost of goods manufactured for the year ended December 31, 2018. 2. As a second step, prepare a new multiple-step income statement for the year ended December 31, 2018. 3. Calculate the cost of producing one unit if the company produced 120,000 units in 2018 (round your answer to two decimal points).

Answers: 2

Another question on Business

Business, 21.06.2019 16:00

Abigail spent $100 on a new edition of the personal finance textbook rather than $75 for a used copy. the additional cost for the new copy is called the

Answers: 1

Business, 22.06.2019 01:00

An investment counselor calls with a hot stock tip. he believes that if the economy remains strong, the investment will result in a profit of $40 comma 00040,000. if the economy grows at a moderate pace, the investment will result in a profit of $10 comma 00010,000. however, if the economy goes into recession, the investment will result in a loss of $40 comma 00040,000. you contact an economist who believes there is a 2020% probability the economy will remain strong, a 7070% probability the economy will grow at a moderate pace, and a 1010% probability the economy will slip into recession. what is the expected profit from this investment?

Answers: 2

Business, 22.06.2019 11:00

If the guide wprds on the page are "crochet " and "crossbones", which words would not be on the page. criticize, crocodile,croquet,crouch,crocus.

Answers: 1

Business, 22.06.2019 12:40

When cell phones were first entering the market, they were relatively large and reception was undependable. all cell phones were essentially the same. but as the technology developed, many competitors entered, introducing features unique to their phones. today, cell phones are only a small fraction of the size and weight of their predecessors. consumers can buy cell phones with color screens, cameras, internet access, daily planners, or voice activation (and any combination of these features). the history of the cell phone demonstrates what marketing trend?

Answers: 3

You know the right answer?

Below is Salem Company’s income statement for 2018 that was prepared by an inexperienced accountant....

Questions

Mathematics, 25.05.2021 23:00

Mathematics, 25.05.2021 23:00

Mathematics, 25.05.2021 23:00

Mathematics, 25.05.2021 23:00