Business, 28.10.2020 16:40 shandrablue6896

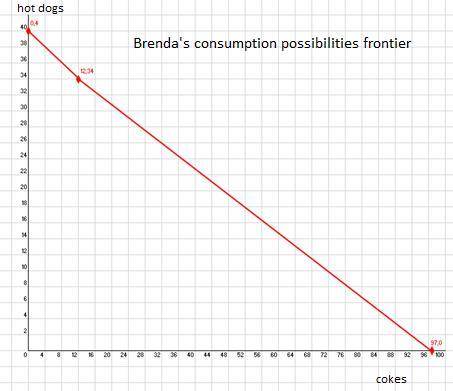

Brenda likes hot dogs and Coca-Cola. Hot dogs cost $1 each and Coca-Cola costs $0.50 per bottle. There is a special promotion for Coca-Cola that will last for one month. If Brenda sends in the bottle tops from the Cokes she drinks during the next month, she will get a refund of $0.10 for every bottle cap beyond the first 12 that she returns. For example, 17 bottles will cost her $0.50 × 12 + $0.40 × 5 = $8. Brenda has $40 to spend on hot dogs and Coca-Cola during the next month. Draw her budget line with Cokes on the horizontal axis and hot dogs on the vertical axis. Find the points where the budget line hits the axes and the point where it has a kink. At each of these three points write down the quantities of each good consumed.

Answers: 1

Another question on Business

Business, 22.06.2019 20:00

Ryngard corp's sales last year were $38,000, and its total assets were $16,000. what was its total assets turnover ratio (tato)? a. 2.04b. 2.14c. 2.26d. 2.38e. 2.49

Answers: 1

Business, 22.06.2019 21:40

Which of the following is one of the main causes of inflation? a. wages drop so workers have to spend a higher percentage of income on necessities. b. demand drops and forces producers to charge more to meet their costs. c. rising unemployment cuts into national income. d. consumers demand goods faster than they can be supplied.

Answers: 3

Business, 23.06.2019 01:00

Need with an adjusting journal entrycmc records depreciation and amortization expense annually. they do not use an accumulated amortization account. (i.e. amortization expense is recorded with a debit to amort. exp and a credit to the patent.) annual depreciation rates are 7% for buildings/equipment/furniture, no salvage. (round to the nearest whole dollar.) annual amortization rates are 10% of original cost, straight-line method, no salvage. cmc owns two patents: patent #fj101 and patent #cq510. patent #cq510 was acquired on october 1, 2016. patent #fj101 was acquired on april 1, 2018 for $119,000. the last time depreciation & amortization were recorded was december 31, 2017.before adjustment: land: 348791equpment and furniture: 332989building: 876418patents 217000

Answers: 3

Business, 23.06.2019 08:00

Wriston company is preparing its cash budget for the upcoming month. the beginning cash balance for the month is expected to be $15,000. budgeted cash disbursements are $72,500, while budgeted cash receipts are $89,600. wriston company wants to have an ending cash balance of $30,000. the excess (deficiency) of cash available over disbursements for the month would be

Answers: 2

You know the right answer?

Brenda likes hot dogs and Coca-Cola. Hot dogs cost $1 each and Coca-Cola costs $0.50 per bottle. The...

Questions

History, 09.11.2020 18:10

Mathematics, 09.11.2020 18:10

History, 09.11.2020 18:10

Mathematics, 09.11.2020 18:10

SAT, 09.11.2020 18:10

English, 09.11.2020 18:10

Mathematics, 09.11.2020 18:10

Mathematics, 09.11.2020 18:10

Mathematics, 09.11.2020 18:20

Mathematics, 09.11.2020 18:20

Mathematics, 09.11.2020 18:20

Chemistry, 09.11.2020 18:20