Business, 29.10.2020 16:40 fonzocoronado3478

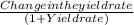

You own a fixed income asset with a MaCaulay duration of 5 years. If the level of required yields, which is currently at 8%, goes down by 0.10%, how much do you expect the price of the asset to change (in

Answers: 1

Another question on Business

Business, 22.06.2019 02:30

When interest is compounded continuously, the amount of money increases at a rate proportional to the amount s present at time t, that is, ds/dt = rs, where r is the annual rate of interest. (a) find the amount of money accrued at the end of 3 years when $4000 is deposited in a savings account drawing 5 3 4 % annual interest compounded continuously. (round your answer to the nearest cent.) $ (b) in how many years will the initial sum deposited have doubled? (round your answer to the nearest year.) years (c) use a calculator to compare the amount obtained in part (a) with the amount s = 4000 1 + 1 4 (0.0575) 3(4) that is accrued when interest is compounded quarterly. (round your answer to the nearest cent.) s = $

Answers: 1

Business, 22.06.2019 10:20

Blue spruce corp. has the following transactions during august of the current year. aug. 1 issues shares of common stock to investors in exchange for $10,170. 4 pays insurance in advance for 3 months, $1,720. 16 receives $710 from clients for services rendered. 27 pays the secretary $740 salary. indicate the basic analysis and the debit-credit analysis.

Answers: 1

Business, 22.06.2019 11:20

Stock a has a beta of 1.2 and a standard deviation of 20%. stock b has a beta of 0.8 and a standard deviation of 25%. portfolio p has $200,000 consisting of $100,000 invested in stock a and $100,000 in stock b. which of the following statements is correct? (assume that the stocks are in equilibrium.) (a) stock b has a higher required rate of return than stock a. (b) portfolio p has a standard deviation of 22.5%. (c) portfolio p has a beta equal to 1.0. (d) more information is needed to determine the portfolio's beta. (e) stock a's returns are less highly correlated with the returns on most other stocks than are b's returns.

Answers: 3

Business, 22.06.2019 18:50

Plastic and steel are substitutes in the production of body panels for certain automobiles. if the price of plastic increases, with other things remaining the same, we would expect: a) the demand curve for plastic to shift to the left. b) the price of steel to fall. c) the demand curve for steel to shift to the left d) nothing to happen to steel because it is only a substitute for plastic. e) the demand curve for steel to shift to the right

Answers: 3

You know the right answer?

You own a fixed income asset with a MaCaulay duration of 5 years. If the level of required yields, w...

Questions

Computers and Technology, 13.10.2020 15:01

Mathematics, 13.10.2020 15:01

Mathematics, 13.10.2020 15:01

Mathematics, 13.10.2020 15:01

English, 13.10.2020 15:01

Mathematics, 13.10.2020 15:01

Mathematics, 13.10.2020 15:01

History, 13.10.2020 15:01

Mathematics, 13.10.2020 15:01

Mathematics, 13.10.2020 15:01

Mathematics, 13.10.2020 15:01

History, 13.10.2020 15:01

Mathematics, 13.10.2020 15:01

Mathematics, 13.10.2020 15:01

Mathematics, 13.10.2020 15:01