Answers: 3

Another question on Business

Business, 22.06.2019 20:00

A$100 million interest rate swap has a remaining life of 10 months. under the terms of the swap, the six-month libor is exchanged semi-annually for 12% per annum. the six-month libor rate in swaps of all maturities is currently 10% per annum with continuous compounding. the six-month libor rate was 9.6% per annum two months ago. what is the current value of the swap to the party paying floating? what is its value to the party paying fixed?

Answers: 2

Business, 23.06.2019 04:50

According to fiedler, in situations that are very unfavorable for the leader, it would be wise to choose someone who: a. is task oriented. b. is likely to engage in behaviors that are classified as consideration behaviors. c. has a low lpc score. d. has a high lpc score.

Answers: 1

Business, 23.06.2019 17:30

On january 1, 2018, gless textiles issued $12 million of 9%, 10-year convertible bonds at 101. the bonds pay interest on june 30 and december 31. each $1,000 bond is convertible into 40 shares of gless’s no par common stock. bonds that are similar in all respects, except that they are nonconvertible, currently are selling at 99 (that is, 99% of face amount). century services purchased 10% of the issue as an investment. on january 1, 2018, gless textiles issued $12 million of 9%, 10-year convertible bonds at 101. the bonds pay interest on june 30 and december 31. each $1,000 bond is convertible into 40 shares of gless’s no par common stock. bonds that are similar in all respects, except that they are nonconvertible, currently are selling at 99 (that is, 99% of face amount). century services purchased 10% of the issue as an investment. 3. on july 1, 2023, when gless’s common stock had a market price of $33 per share, century converted the bonds it held. prepare the journal entries by both gless and century for the conversion of the bonds (book value method).

Answers: 2

You know the right answer?

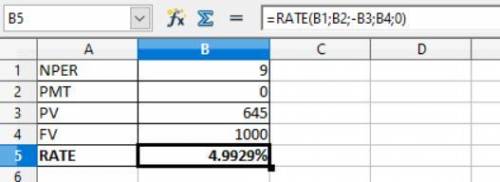

Builtrite currently has a $1000 par, 9 year maturity, zero coupon bond outstanding that is selling f...

Questions

Mathematics, 12.10.2019 18:00

History, 12.10.2019 18:00

Mathematics, 12.10.2019 18:00

Mathematics, 12.10.2019 18:00

Mathematics, 12.10.2019 18:00

English, 12.10.2019 18:00

Mathematics, 12.10.2019 18:00

History, 12.10.2019 18:00

Mathematics, 12.10.2019 18:00

History, 12.10.2019 18:00