Business, 04.11.2020 18:30 kaaylon8285

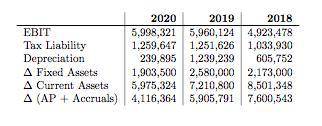

If you expect the target firm to grow at your calculated annual growth rate for the next four years (2021- 2024) and then beyond grow at an annual rate of 2%, , what is the value of the entire target firm assuming a weighted average cost of capital (WACC) of 10.5%

Answers: 1

Another question on Business

Business, 22.06.2019 12:00

In the united states, one worker can produce 10 tons of steel per day or 20 tons of chemicals per day. in the united kingdom, one worker can produce 5 tons of steel per day or 15 tons of chemicals per day. the united kingdom has a comparative advantage in the production of:

Answers: 2

Business, 22.06.2019 19:10

Below are the steps in the measurement process of external transactions. arrange them from first (1) to last (6). event step post transactions to the general ledger. assess whether the transaction results in a debit or credit to account balances. use source documents to identify accounts affected by an external transaction. analyze the impact of the transaction on the accounting equation. prepare a trial balance. record the transaction in a journal using debits and credits.

Answers: 3

Business, 22.06.2019 23:30

Shelby bought her dream car, a 1966 red convertible mustang, with a loan from her credit union. if shelby paid 5.1% and the bank earned a real rate of return of 3.5%, what was the inflation rate over the life of the loan?

Answers: 2

Business, 23.06.2019 07:00

Which (if any) of the following scenarios is the result of a natural monopoly? instructions: you may select more than one answer. a. patent holders of genetically modified seeds are permitted to sue farmers who save seeds from one planting season to the next. b. doctors in the united states are prohibited from practicing without a medical license. c. there is one train operator with service from baltimore to philadelphia. d. coal is used as the primary energy in a country with abundant coal deposits.

Answers: 1

You know the right answer?

If you expect the target firm to grow at your calculated annual growth rate for the next four years...

Questions

English, 07.07.2019 13:30

Mathematics, 07.07.2019 13:30

English, 07.07.2019 13:30

Mathematics, 07.07.2019 13:30

Mathematics, 07.07.2019 13:30

Biology, 07.07.2019 13:30

History, 07.07.2019 13:30

History, 07.07.2019 13:30

History, 07.07.2019 13:30

Mathematics, 07.07.2019 13:30

History, 07.07.2019 13:30

Mathematics, 07.07.2019 13:30