Business, 04.11.2020 19:00 debramknoxx

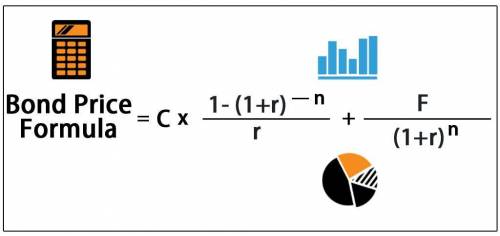

Lunar, Inc., plans to issue $900,000 of 10% bonds that will pay interest semiannually and mature in 5 years. Assume that the effective interest rate is 12% per year compounded semiannually. Compute the selling price of the bonds. Use Tables 2 and 3 in Appendix A near the end of the book.

Answers: 1

Another question on Business

Business, 22.06.2019 10:00

Scenario: you have advised the owner of bond's gym that the best thing to do would be to raise the price of a monthly membership. the owner wants to know what may happen once this price increase goes into effect. what will most likely occur after the price of a monthly membership increases? check all that apply. current members will pay more per month. the quantity demanded for memberships will decrease. the number of available memberships will increase. the owner will make more money. bond's gym will receive more membership applications.

Answers: 1

Business, 22.06.2019 14:00

Wallace company provides the following data for next year: month budgeted sales january $120,000 february 108,000 march 140,000 april 147,000 the gross profit rate is 35% of sales. inventory at the end of december is $29,600 and target ending inventory levels are 10% of next month's sales, stated at cost. what is the amount of purchases budgeted for january?

Answers: 1

Business, 22.06.2019 18:00

If you would like to ask a question you will have to spend some points

Answers: 1

You know the right answer?

Lunar, Inc., plans to issue $900,000 of 10% bonds that will pay interest semiannually and mature in...

Questions

Physics, 23.04.2020 04:16

Mathematics, 23.04.2020 04:16

Biology, 23.04.2020 04:16

History, 23.04.2020 04:16

Advanced Placement (AP), 23.04.2020 04:16

Mathematics, 23.04.2020 04:17

Mathematics, 23.04.2020 04:17