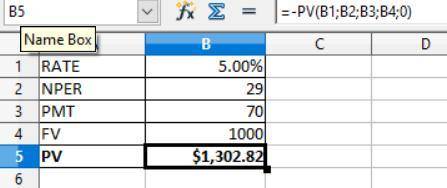

Leggio Inc. issued bonds with a 30-year maturity one year ago. The bonds have a 7% coupon, make one payment per year, and sold at their $1,000 par value at issue because the going market rate at the time was 7%. Now, one year later, the market rate has declined from 7% to 5%. At what price should Leggio's bonds now sell?

Answers: 2

Another question on Business

Business, 22.06.2019 07:30

Fill in the missing words to correctly complete each sentence about analyzing a job posting. when reviewing a job posting, it’s important to check theto determine whether it’s worth your time to apply. if the post has been up for a while or it’s already closed, move on to the next position. if it’s still available, take note of when it closes so you’ll know when you mayfrom the company in regard to an interview.

Answers: 1

Business, 22.06.2019 07:30

Select the correct answer the smith family adopted a child. the adoption procedure took about three months, and the family incurred various expenses. will the smiths receive and financial benefit for the taxable year? a) they will not receive any financial benefit for adopting the child b) their income tax component will decrease c) they will receive childcare grants d) they will receive a tax credit for the cost borne for adopting the child e) they will receive several tax deductions

Answers: 3

Business, 22.06.2019 11:10

Sam and diane are completing their federal income taxes for the year and have identified the amounts listed here. how much can they rightfully deduct? • agi: $80,000 • medical and dental expenses: $9,000 • state income taxes: $3,500 • mortgage interest: $9,500 • charitable contributions: $1,000.

Answers: 1

Business, 22.06.2019 15:00

(a) what was the opportunity cost of non-gm food for many buyers before 2008? (b) why did they prefer the alternative? (c) what was the opportunity cost in 2008? (d) why did it change?

Answers: 2

You know the right answer?

Leggio Inc. issued bonds with a 30-year maturity one year ago. The bonds have a 7% coupon, make one...

Questions

Social Studies, 31.01.2020 10:52

Mathematics, 31.01.2020 10:53

History, 31.01.2020 10:53

Mathematics, 31.01.2020 10:53

World Languages, 31.01.2020 10:53

Mathematics, 31.01.2020 10:53

Mathematics, 31.01.2020 10:53