Business, 18.11.2020 17:00 arushiverma555

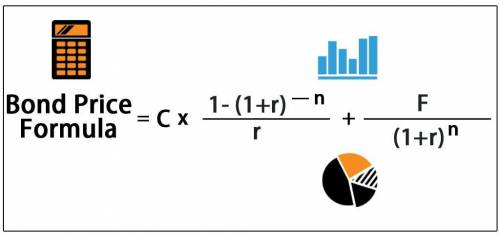

Laurel, Inc., and Hardy Corp. both have 9 percent coupon bonds outstanding, with semiannual interest payments, and both are priced at par value. The Laurel, Inc., bond has four years to maturity, whereas the Hardy Corp. bond has 15 years to maturity.

If interest rates suddenly rise by 2 percent, what is the percentage change in the price of these bonds?(Negative answers should be indicated by a minus sign. Do not round intermediate calculations and round your final answers to 2 decimal places. (e. g., 32.16))

Percentage change in price of Laurel%

Percentage change in price of Hardy%

If interest rates were to suddenly fall by 2 percent instead, what would the percentage change in the price of these bonds be then? (Do not round intermediate calculations and round your final answers to 2 decimal places. (e. g., 32.16))

Percentage change in price of Laurel%

Percentage change in price of Hardy%

Answers: 2

Another question on Business

Business, 22.06.2019 01:30

Iam trying to get more members on my blog. how do i do that?

Answers: 2

Business, 22.06.2019 06:40

After the 2008 recession, the amount of reserves in the us banking system increased. because of federal reserve actions, required reserves increased from $44 billion to $60 billion. however, banks started holding more reserves than required. by january 2009, banks were holding $900 billion in excess reserves. the federal reserve started paying interest on the excess reserves that the banks held. what possible impact will these unused reserves have on the economy?

Answers: 1

Business, 22.06.2019 07:30

Jewelry manufacturers produce a range of products such as rings, necklaces, bracelets, and brooches. what fundamental economic question are they addressing by offering this range of items?

Answers: 3

Business, 22.06.2019 12:00

Identify at least 3 body language messages that project a positive attitude

Answers: 2

You know the right answer?

Laurel, Inc., and Hardy Corp. both have 9 percent coupon bonds outstanding, with semiannual interest...

Questions

English, 23.03.2021 14:00

French, 23.03.2021 14:00

Mathematics, 23.03.2021 14:00

Biology, 23.03.2021 14:00

Mathematics, 23.03.2021 14:00

Health, 23.03.2021 14:00

Computers and Technology, 23.03.2021 14:00

History, 23.03.2021 14:00

Mathematics, 23.03.2021 14:00

Health, 23.03.2021 14:00

Mathematics, 23.03.2021 14:00

Mathematics, 23.03.2021 14:00

Mathematics, 23.03.2021 14:00

Chemistry, 23.03.2021 14:00

Health, 23.03.2021 14:00