Business, 15.12.2020 02:00 dorindaramirez0531

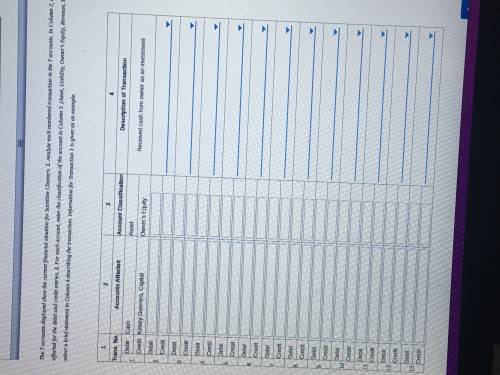

The T accounts displayed show the current financial situation for Sunshine Cleaners. 1. Analyze each numbered transaction in the T accounts. In Column 2, enter the titles of accounts affected for the debit and credit entries. 2. For each account, enter the classification of the account in Column 3. (Asset, Liability, Owner’s Equity, Revenue, Expense) 3. For each transaction, select a brief statement in Column 4 describing the transaction. Information for Transaction 1 is given as an example.

Answers: 3

Another question on Business

Business, 21.06.2019 21:20

Abakery wants to determine how many trays of doughnuts it should prepare each day. demand is normal with a mean of 5 trays and standard deviation of 1 tray. if the owner wants a service level of at least 95%, how many trays should he prepare (rounded to the nearest whole tray)? assume doughnuts have no salvage value after the day is complete.

Answers: 2

Business, 22.06.2019 00:20

Suppose an economy consists of three sectors: energy (e), manufacturing (m), and agriculture (a). sector e sells 70% of its output to m and 30% to a. sector m sells 30% of its output to e, 50% to a, and retains the rest. sector a sells 15% of its output to e, 30% to m, and retains the rest.

Answers: 1

Business, 22.06.2019 14:10

Carey company is borrowing $225,000 for one year at 9.5 percent from second intrastate bank. the bank requires a 15 percent compensating balance. the principal refers to funds the firm can effectively utilize (amount borrowed − compensating balance). a. what is the effective rate of interest? (use a 360-day year. input your answer as a percent rounded to 2 decimal places.) b. what would the effective rate be if carey were required to make 12 equal monthly payments to retire the loan?

Answers: 1

Business, 22.06.2019 15:20

Record the journal entry for the provision for uncollectible accounts under each of the following independent assumptions: a. the allowance for doubtful accounts before adjustment has a credit balance of $500. b. the allowance for doubtful accounts before adjustment has a debit balance of $250. c. assume that octoberʼs credit sales were $70,000. uncollectible accounts expense is estimated at 2% of sales. smith, gaylord n.. excel applications for accounting principles (p. 51). cengage textbook. kindle edition.

Answers: 1

You know the right answer?

The T accounts displayed show the current financial situation for Sunshine Cleaners. 1. Analyze each...

Questions

Arts, 14.10.2021 02:20

Mathematics, 14.10.2021 02:20

Advanced Placement (AP), 14.10.2021 02:20

Mathematics, 14.10.2021 02:20

Mathematics, 14.10.2021 02:20

Arts, 14.10.2021 02:20

Mathematics, 14.10.2021 02:20

Mathematics, 14.10.2021 02:20

Mathematics, 14.10.2021 02:20

Mathematics, 14.10.2021 02:20

Chemistry, 14.10.2021 02:20

History, 14.10.2021 02:20

Physics, 14.10.2021 02:20

Social Studies, 14.10.2021 02:20