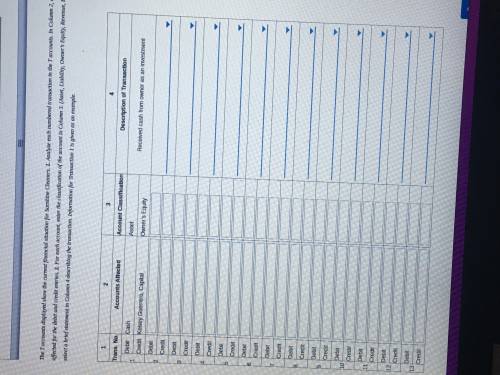

The T accounts displayed show the current financial situation for Sunshine Cleaners. 1. Analyze each numbered transaction in the T accounts. In Column 2, enter the titles of accounts affected for the debit and credit entries. 2. For each account, enter the classification of the account in Column 3. (Asset, Liability, Owner’s Equity, Revenue, Expense) 3. For each transaction, select a brief statement in Column 4 describing the transaction. Information for Transaction 1 is given as an example.

Answers: 2

Another question on Business

Business, 22.06.2019 01:30

If a firm plans to issue new stock, flotation costs (investment bankers' fees) should not be ignored. there are two approaches to use to account for flotation costs. the first approach is to add the sum of flotation costs for the debt, preferred, and common stock and add them to the initial investment cost. because the investment cost is increased, the project's expected return is reduced so it may not meet the firm's hurdle rate for acceptance of the project. the second approach involves adjusting the cost of common equity as follows: . the difference between the flotation-adjusted cost of equity and the cost of equity calculated without the flotation adjustment represents the flotation cost adjustment. quantitative problem: barton industries expects next year's annual dividend, d1, to be $1.90 and it expects dividends to grow at a constant rate g = 4.3%. the firm's current common stock price, p0, is $22.00. if it needs to issue new common stock, the firm will encounter a 6% flotation cost, f. assume that the cost of equity calculated without the flotation adjustment is 12% and the cost of old common equity is 11.5%. what is the flotation cost adjustment that must be added to its cost of retaine

Answers: 1

Business, 22.06.2019 05:20

142"what is the value of n? soefon11402bebe99918+19: 00esseeshop60-990 0esle

Answers: 1

Business, 22.06.2019 20:40

Robert owns a life insurance policy that he purchased when he first graduated college. it has a $100,000 death benefit and robert pays premiums for it every month out of his checking account. the insurance robert has is most likely da. permanent life insurance o b. term life insurance o c. group life insurance o d. individual life insurance

Answers: 1

Business, 23.06.2019 00:00

Asap! the following information is given for tripp company which uses the indirect method.

Answers: 1

You know the right answer?

The T accounts displayed show the current financial situation for Sunshine Cleaners. 1. Analyze each...

Questions

Mathematics, 19.02.2021 01:00

Mathematics, 19.02.2021 01:00

Physics, 19.02.2021 01:00

Mathematics, 19.02.2021 01:00

History, 19.02.2021 01:00

Mathematics, 19.02.2021 01:00

English, 19.02.2021 01:00