Business, 21.12.2020 19:00 ionmjnm3041

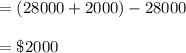

Bud exchanges land with an adjusted basis of $ 22,000 and a fair market value of $ 30,000 for another parcel of land with a fair market value of $ 28,000 and $2,000 cash. What is Bud's recognized gain or loss?

a. $0

b. $2,000

c. $6,000

d. $8,000

e. None of the above

Answers: 2

Another question on Business

Business, 21.06.2019 19:50

Which of the following best describes the economic effect that results when the government increases interest rates and restricts the lending of money? a. borrowing money becomes more expensive and there is less investment in production. b. the economy grows as investments result in larger profits. c. government spending drives up prices because of greater competition for goods and services. d. consumers save more money and spend less buying goods and services.

Answers: 2

Business, 22.06.2019 19:50

What is the present value of the following cash flow stream at a rate of 12.0%? years: 0 1 2 3 4| | | | |cfs: $0 $1,500 $3,000 $4,500 $6,000a. $9,699b. $10,210c. $10,747d. $11,284e. $11,849

Answers: 3

Business, 22.06.2019 22:00

Retail industry fundamentals credential exam,part 1 all answers

Answers: 3

Business, 23.06.2019 02:30

How is the role of government determined in the american free enterprise system?

Answers: 2

You know the right answer?

Bud exchanges land with an adjusted basis of $ 22,000 and a fair market value of $ 30,000 for anothe...

Questions

Biology, 10.04.2020 05:05

English, 10.04.2020 05:05

Mathematics, 10.04.2020 05:05

Mathematics, 10.04.2020 05:05

Biology, 10.04.2020 05:06

Mathematics, 10.04.2020 05:06

History, 10.04.2020 05:06

Mathematics, 10.04.2020 05:06

Mathematics, 10.04.2020 05:06

History, 10.04.2020 05:06