Business, 23.12.2020 22:10 realoneree

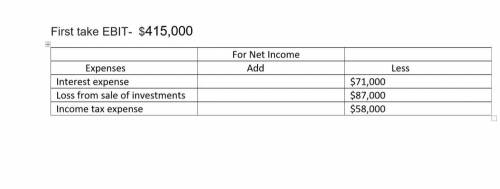

The Willie Company has provided the following information: Operating expenses were $345,000; Income from operations was $415,000; Net sales were $1,100,000; Interest expense was $71,000; Loss from sale of investments was $87,000; Income tax expense was $58,000. What was Willie's net income

Answers: 1

Another question on Business

Business, 22.06.2019 11:30

Marta communications, inc. has provided incomplete financial statements for the month ended march 31. the controller has asked you to calculate the missing amounts in the incomplete financial statements. use the information included in the excel simulation and the excel functions described below to complete the task

Answers: 1

Business, 22.06.2019 12:20

If jobs have been undercosted due to underallocation of manufacturing overhead, then cost of goods sold (cogs) is too low and which of the following corrections must be made? a. decrease cogs for double the amount of the underallocation b. increase cogs for double the amount of the underallocation c. decrease cogs for the amount of the underallocation d. increase cogs for the amount of the underallocation

Answers: 3

Business, 22.06.2019 17:00

Afinancing project has an initial cash inflow of $42,000 and cash flows of −$15,600, −$22,200, and −$18,000 for years 1 to 3, respectively. the required rate of return is 13 percent. what is the internal rate of return? should the project be accepted?

Answers: 1

Business, 22.06.2019 17:00

During which of the following phases of the business cycle does the real gdp fall? a. trough b. expansion c. contraction d. peak

Answers: 2

You know the right answer?

The Willie Company has provided the following information: Operating expenses were $345,000; Income...

Questions

Social Studies, 18.12.2019 04:31

Mathematics, 18.12.2019 04:31