Business, 25.12.2020 17:00 lareynademividp0a99r

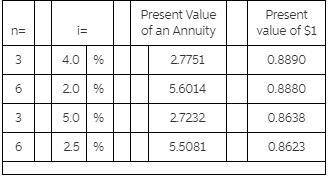

On January 1, a company issues bonds dated January 1 with a par value of $200,000. The bonds mature in 3 years. The contract rate is 4%, and interest is paid semiannually on June 30 and December 31. The market rate is 5%. Using the present value factors below, the issue (selling) price of the bonds is:

Answers: 1

Another question on Business

Business, 21.06.2019 23:30

San ruiz interiors provides design services to residential and commercial clients. the residential services produce a contribution margin of $450,000 and have traceable fixed operating costs of $480,000. management is studying whether to drop the residential operation. if closed, the fixed operating costs will fall by $370,000 and san ruiz’ income will

Answers: 3

Business, 22.06.2019 19:00

Describe how to write a main idea expressed as a bottom-line statement

Answers: 3

Business, 22.06.2019 22:40

Colorado rocky cookie company offers credit terms to its customers. at the end of 2018, accounts receivable totaled $715,000. the allowance method is used to account for uncollectible accounts. the allowance for uncollectible accounts had a credit balance of $50,000 at the beginning of 2018 and $30,000 in receivables were written off during the year as uncollectible. also, $3,000 in cash was received in december from a customer whose account previously had been written off. the company estimates bad debts by applying a percentage of 15% to accounts receivable at the end of the year. 1. prepare journal entries to record the write-off of receivables, the collection of $3,000 for previously written off receivables, and the year-end adjusting entry for bad debt expense.2. how would accounts receivable be shown in the 2018 year-end balance sheet?

Answers: 1

Business, 23.06.2019 01:00

"consists of larger societal forces that affect how a company engages and serves its customers."

Answers: 1

You know the right answer?

On January 1, a company issues bonds dated January 1 with a par value of $200,000. The bonds mature...

Questions

Mathematics, 24.05.2021 14:00

English, 24.05.2021 14:00

Mathematics, 24.05.2021 14:00

Mathematics, 24.05.2021 14:00

History, 24.05.2021 14:00

Computers and Technology, 24.05.2021 14:00

Mathematics, 24.05.2021 14:00

Social Studies, 24.05.2021 14:00

Mathematics, 24.05.2021 14:00

Computers and Technology, 24.05.2021 14:00

English, 24.05.2021 14:00

World Languages, 24.05.2021 14:00

Biology, 24.05.2021 14:00