The lease payments from footnote disclosures of an operating lease

Year Lease payments ($)

1. 1,375

2. 1,210

3. 825

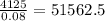

Year 4 and after 4,125

Assume a discount rate of 8%.

Required:

a. Calculate the PV of all the lease payments.

b. Assume a 10% discount rate and a tax rate of 25%, so that the PV of all the lease payments is $5,220. Complete the I/S figures .

Answers: 2

Another question on Business

Business, 21.06.2019 20:30

In general, as long as the number of firms that possess a particular valuable resource or capability is less than the number of firms needed to generate perfect competition dynamics in an industry, that resource or capability can be considered and a potential source of competitive advantage.answers: valuablerareinimitableun-substitutable

Answers: 1

Business, 22.06.2019 20:00

Double corporation acquired all of the common stock of simple company for

Answers: 1

Business, 22.06.2019 23:30

As a result of a thorough physical inventory, waterway company determined that it had inventory worth $320200 at december 31, 2020. this count did not take into consideration the following facts: walker consignment currently has goods worth $47400 on its sales floor that belong to waterway but are being sold on consignment by walker. the selling price of these goods is $75900. waterway purchased $21900 of goods that were shipped on december 27, fob destination, that will be received by waterway on january 3. determine the correct amount of inventory that waterway should report.

Answers: 2

Business, 23.06.2019 01:30

At the end of the fiscal year, apha airlines has an outstanding non-cancellable purchase commitment for the purchase of 1 million gallons of jet fuel at a price of $4.10 per gallon for delivery during the coming summer. the company prices its inventory at the lower of cost or market. if the market price for jet fuel at the end of the year is $4.50, how would this situation be reflected in the annual financial statements?

Answers: 2

You know the right answer?

The lease payments from footnote disclosures of an operating lease

Year Lease payments ($)

1...

1...

Questions

Chemistry, 12.02.2022 23:50

Biology, 12.02.2022 23:50

Mathematics, 12.02.2022 23:50

Mathematics, 12.02.2022 23:50

Chemistry, 12.02.2022 23:50

Mathematics, 12.02.2022 23:50

Advanced Placement (AP), 12.02.2022 23:50

Mathematics, 12.02.2022 23:50

Mathematics, 12.02.2022 23:50

Mathematics, 12.02.2022 23:50

Biology, 12.02.2022 23:50