Business, 04.01.2021 01:50 olallaaguirre

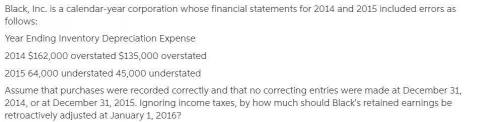

Black, Inc. is a calendar-year corporation whose financial statements for 2014 and 2015 included errors as follows: PHOTO

Assume that purchases were recorded correctly and that no correcting entries were made at December 31, 2014, or at December 31, 2015. Ignoring income taxes, by how much should Black's retained earnings be retroactively adjusted at January 1, 2016?

a. $154,000 increase

b. $46,000 increase

c. $19,000 decrease

d. $8,000 increase

Answers: 1

Another question on Business

Business, 21.06.2019 21:00

The table shows the demand and supply schedules for magazines. complete the following sentences. the equilibrium price of a magazine is $ 4 and the equilibrium quantity is 150 magazines a week. price (dollars per magazine) quantity demanded quantity supplied (magazines per week) 3.00 160 138 3.50 155 144 4.00 150 150 4.50 145 156 5.00 140 161 now a fall in the price of a newspaper decreases the quantity demanded by 11 magazines a week at each price. at the original equilibrium price, a occurs. to return to equilibrium, the price of a magazine a. surplus; rises b. shortage; rises c. shortage; falls d. surplus; falls as the market returns to equilibrium, the quantity demanded and the quantity supplied a. decreases; increases b. decreases; decreases c. increases; decreases d. increases; increases the new equilibrium price is $ nothing a magazine.

Answers: 1

Business, 21.06.2019 21:30

Which of these things did galileo not do? a. stop publishing his scientific work after being convicted of heresy b. invent the concept of acceleration c. experiment with rolling balls down ramps of increasing steepness to test how objects would fall d. argue that earth moves around the sun e. make up a thought experiment that indicated that objects would fall at the same rate

Answers: 3

Business, 22.06.2019 03:00

Afirm's before-tax cost of debt, rd, is the interest rate that the firm must pay on debt. because interest is tax deductible, the relevant cost of debt used to calculate a firm's wacc is the cost of debt, rd (1 – t). the cost of debt is used in calculating the wacc because we are interested in maximizing the value of the firm's stock, and the stock price depends on cash flows. it is important to emphasize that the cost of debt is the interest rate on debt, not debt because our primary concern with the cost of capital is its use in capital budgeting decisions. the rate at which the firm has borrowed in the past is because we need to know the cost of capital. for these reasons, the on outstanding debt (which reflects current market conditions) is a better measure of the cost of debt than the . the on the company's -term debt is generally used to calculate the cost of debt because more often than not, the capital is being raised to fund -term projects. quantitative problem: 5 years ago, barton industries issued 25-year noncallable, semiannual bonds with a $1,600 face value and a 8% coupon, semiannual payment ($64 payment every 6 months). the bonds currently sell for $845.87. if the firm's marginal tax rate is 40%, what is the firm's after-tax cost of debt? round your answer to 2 decimal places. do not round intermediate calcu

Answers: 3

You know the right answer?

Black, Inc. is a calendar-year corporation whose financial statements for 2014 and 2015 included err...

Questions

Mathematics, 12.02.2021 17:40

Mathematics, 12.02.2021 17:40

Mathematics, 12.02.2021 17:40

Mathematics, 12.02.2021 17:40

Mathematics, 12.02.2021 17:40

Mathematics, 12.02.2021 17:40

Mathematics, 12.02.2021 17:40

Computers and Technology, 12.02.2021 17:40

Mathematics, 12.02.2021 17:40