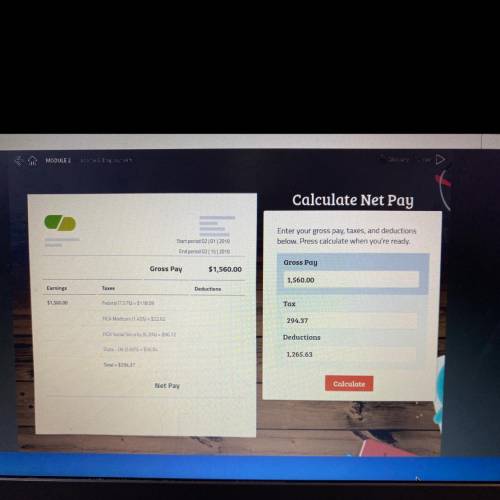

Calculate Net Pay

Enter your gross pay, taxes, and deductions

below. Press calculate when you...

Business, 09.01.2021 01:00 sandra5456

Calculate Net Pay

Enter your gross pay, taxes, and deductions

below. Press calculate when you're ready.

Start period 02/01/2019

End period 02152019

Gross Pay

Gross Pay

$1,560.00

1,560.00

Earnings

Taxes

Deductions

$1.560.00

Federal (757) $118.09

Tax

FICA Medicare (1451 - 52262

294.37

FICA Social Security 16.2012 - 596.72

Deductions

State OK 13.650 - 55604

1,265.63

Total $2931

Calculate

Net Pay

Ok

Answers: 2

Another question on Business

Business, 22.06.2019 06:20

About time delivery co. incurred the following costs related to trucks and vans used in operating its delivery service: classify each of the costs as a capital expenditure or a revenue expenditure. 1. changed the oil and greased the joints of all the trucks and vans. 2. changed the radiator fluid on a truck that had been in service for the past four years. 3. installed a hydraulic lift to a van. 4. installed security systems on four of the newer trucks. 5. overhaul the engine on one of the trucks purchased three years ago. 6. rebuilt the transmission on one of the vans that had been driven 40,000 miles. the van was no longer under warranty. 7. removed a two-way radio from one of the trucks and installed a new radio with a greater range of communication. 8. repaired a flat tire on one of the vans. 9. replaced a truck's suspension system with a new suspension system that allows for the delivery of heavier loads. 10. tinted the back and side windows of one of the vans to discourage theft of contents.

Answers: 1

Business, 22.06.2019 14:40

In the fall of 2008, aig, the largest insurance company in the world at the time, was at risk of defaulting due to the severity of the global financial crisis. as a result, the u.s. government stepped in to support aig with large capital injections and an ownership stake. how would this affect, if at all, the yield and risk premium on aig corporate debt?

Answers: 3

Business, 22.06.2019 15:20

Record the journal entry for the provision for uncollectible accounts under each of the following independent assumptions: a. the allowance for doubtful accounts before adjustment has a credit balance of $500. b. the allowance for doubtful accounts before adjustment has a debit balance of $250. c. assume that octoberʼs credit sales were $70,000. uncollectible accounts expense is estimated at 2% of sales. smith, gaylord n.. excel applications for accounting principles (p. 51). cengage textbook. kindle edition.

Answers: 1

Business, 22.06.2019 18:10

Find the zeros of the polynomial 5 x square + 12 x + 7 by factorization method and verify the relation between zeros and coefficient of the polynomials

Answers: 1

You know the right answer?

Questions

Mathematics, 22.03.2021 08:30

Mathematics, 22.03.2021 08:30

English, 22.03.2021 08:30

Mathematics, 22.03.2021 08:30

History, 22.03.2021 08:30

Mathematics, 22.03.2021 08:30

Business, 22.03.2021 08:30

English, 22.03.2021 08:30

Mathematics, 22.03.2021 08:30

Social Studies, 22.03.2021 08:30

Mathematics, 22.03.2021 08:30

English, 22.03.2021 08:40