Business, 19.01.2021 19:20 abemorales

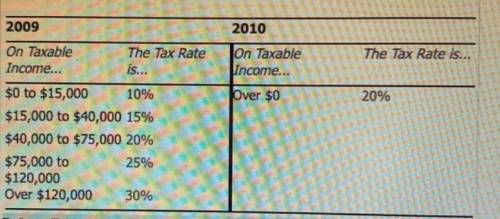

The following table shows the marginal tax rates for unmarried individuals for two years.

2009 2010

On Taxable The Tax Rate On Taxable The Tax Rate is...

Income... is... Income...

$0 to $15,000 10% Over $0 20%

$15,000 to $40,000 15%

$40,000 to $75,000 20%

$75,000 to 25%

$120,000

Over $120,000 30%

Refer to Table: For an individual who earned $35,000 in taxable income in both years, which of the following describes the change in the individual's marginal tax rate between the two years?

a. The marginal tax rate increased from 2009 to 2010.

b. The marginal tax rate decreased from 2009 to 2010.

c. The marginal tax rate remained constant from 2009 to 2010.

d. The change in the marginal tax rate cannot be determined for the two ta schedules shown.

Answers: 3

Another question on Business

Business, 21.06.2019 23:30

As manager of kids skids, meghan wants to develop her relationship management skills. in order to do this, she learns how to

Answers: 2

Business, 22.06.2019 10:20

The following information is for alex corp: product x: revenue $12.00 variable cost $4.50 product y: revenue $44.50 variable cost $9.50 total fixed costs $75,000 what is the breakeven point assuming the sales mix consists of two units of product x and one unit of product y?

Answers: 3

Business, 23.06.2019 02:50

Expert computers was started in 2018. the company experienced the following accounting events during its first year of operation: started business when it acquired $40,000 cash from the issue of common stock. purchased merchandise with a list price of $32,000 on account, terms 2/10, n/30. paid off one-half of the accounts payable balance within the discount period. sold merchandise on account for $28,000. credit terms were 1/20, n/30. the merchandise had cost expert computers $16,000. collected cash from the account receivable within the discount period. paid $2,100 cash for operating expenses. paid the balance due on accounts payable. the payment was not made within the discount period. required record the events in a horizontal statements model below. in the cash flows column, use the letters oa to designate operating activity, ia for investing activity, fa for financing activity, or nc for net change in cash. if the account is not affected by the event, leave the cell blank. the first event is recorded as an example. what is the amount of gross margin for the period? what is the net income for the period?

Answers: 1

Business, 23.06.2019 04:40

Which qualifications have an importance level higher than 60 for a career as a customer service representative? select all that apply operation monitoring mathematics service orientation reading comprehension persuasion learning strategies speaking

Answers: 1

You know the right answer?

The following table shows the marginal tax rates for unmarried individuals for two years.

2009 2010...

Questions

History, 20.01.2021 23:20

Advanced Placement (AP), 20.01.2021 23:20

Chemistry, 20.01.2021 23:20

Mathematics, 20.01.2021 23:20

Mathematics, 20.01.2021 23:20

English, 20.01.2021 23:20

English, 20.01.2021 23:20

Mathematics, 20.01.2021 23:20

Mathematics, 20.01.2021 23:20

Mathematics, 20.01.2021 23:20

Arts, 20.01.2021 23:20

Mathematics, 20.01.2021 23:20