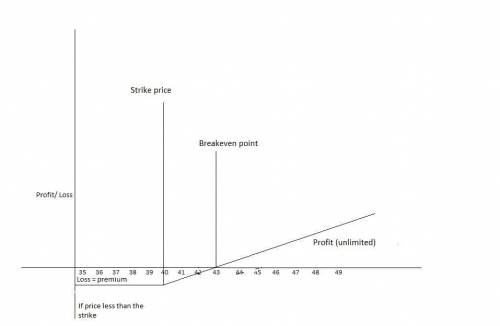

You have purchased one call option expiring in one year with a strike price of $40. The current price of the underlying is $30, the interest rate is zero, and the premium for the call option is $2.63.

1) Draw the payoff and P&L diagrams for the call option at expiration.

2) What is the P&L on the option at expiration if the underlying is $57.50 (i. e. S1 = 57.5)?

Answers: 3

Another question on Business

Business, 22.06.2019 04:40

Select the correct text in the passage.which sentences in the given passage explains the limitations of monetary policies? monetary policies - limitationsmonetary policies are set by the central bank to bring about growth in the economy.de can be achieved these policiesw at anden i sca poit would be fair to say that changes in the economy cannot be brought about instantly by monetary po des.monetary policy can only influence not control, economic growththe monetary policy makers do work on sining the perfect balance between demand and supply of money in the economy

Answers: 3

Business, 22.06.2019 10:30

True or false: a fitted model with more predictors will necessarily have a lower training set error than a model with fewer predictors.

Answers: 2

Business, 22.06.2019 11:30

Florence invested in a factory requiring. federally-mandated reductions in carbon emissions. how will this impact florence as the factory's owner? a. her factory will be worth less once the upgrades are complete. b. her factory will likely be bought by the epa. c. florence will have to invest a large amount of capital to update the factory for little financial gain. d. florence will have to invest a large amount of capital to update the factory for a large financial gain.

Answers: 1

Business, 22.06.2019 12:40

Kumar consulting operates several stock investment portfolios that are used by firms for investment of pension plan assets. last year, one portfolio had a realized return of 12.6 percent and a beta coefficient of 1.15. the average t-bond rate was 7 percent and the realized rate of return on the s& p 500 was 12 percent. what was the portfolio's alpha?

Answers: 1

You know the right answer?

You have purchased one call option expiring in one year with a strike price of $40. The current pric...

Questions

Mathematics, 11.05.2021 01:00

Mathematics, 11.05.2021 01:00

Mathematics, 11.05.2021 01:00

History, 11.05.2021 01:00

Mathematics, 11.05.2021 01:00

History, 11.05.2021 01:00

Biology, 11.05.2021 01:00

History, 11.05.2021 01:00