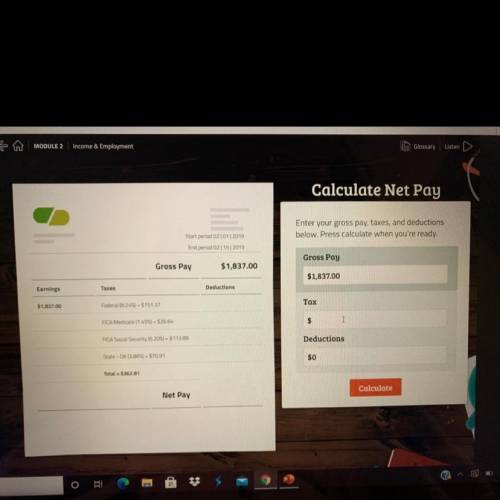

Calculate Net Pay

Enter your gross pay, taxes, and deductions

below. Press calculate when you...

Business, 27.01.2021 03:40 auviannadority13

Calculate Net Pay

Enter your gross pay, taxes, and deductions

below. Press calculate when you're ready.

Start period 02/01/2019

End period 02152019

Gross Pay

Gross Pay

$1,837.00

$1,837.00

Earnings

Taxes

Deductions

$1,837.00

Federal (8.24) - $ 151.37

Tax

FICA Medicare (1.451) - $26.64

FICA Social Security (6.20%) - $113.89

Deductions

State - OK (3.86%) - $70.91

$0

Total = $362.81

Net Pay

Calculate

Answers: 1

Another question on Business

Business, 22.06.2019 08:50

Dyed-denim corporation is seeking to lower the costs of value creation and achieve a low-cost position. as a result, it plans to move its manufacturing plant from the u.s. to thailand, which based on company research, is the optimal location for production. this strategic move will most likely allow the company to realize

Answers: 3

Business, 22.06.2019 19:30

Alaska king crab fishing in the 1960s and '70s was a dangerous but rich fishery. boats from as far away as california and japan braved the treacherous gulf of alaska crossing to reach the abundant king crab beds in cook inlet and bristol bay. suddenly, in the early 1980s, the fishery crashed due to over fishing. all crabbing in those areas ended. to this day, there is no crabbing in bristol bay or cook inlet. a. how would an economist explain the decline of the alaska king crab fishery

Answers: 3

Business, 22.06.2019 21:00

At present, the united states has an embargo against north korea because a. the two countries have extremely poor political relations. b. north korea will not adopt a capitalist government. c. north korean products are too difficult to use. d. north korea has an embargo on american products. e. products from north korea are in higher demand than american-made products.

Answers: 2

Business, 22.06.2019 22:50

For 2016, gourmet kitchen products reported $22 million of sales and $19 million of operating costs (including depreciation). the company has $15 million of total invested capital. its after-tax cost of capital is 10%, and its federal-plus-state income tax rate was 36%. what was the firm’s economic value added (eva), that is, how much value did management add to stockholders’ wealth during 2016?

Answers: 1

You know the right answer?

Questions

Mathematics, 13.11.2020 18:20

Mathematics, 13.11.2020 18:20

Mathematics, 13.11.2020 18:20

Mathematics, 13.11.2020 18:20

Mathematics, 13.11.2020 18:20

Social Studies, 13.11.2020 18:20

Spanish, 13.11.2020 18:20

Mathematics, 13.11.2020 18:20

Mathematics, 13.11.2020 18:20

Mathematics, 13.11.2020 18:20

English, 13.11.2020 18:20

Mathematics, 13.11.2020 18:20