Business, 05.02.2021 22:20 morronefamily1

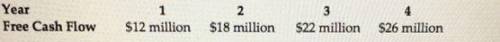

Choro Mining is expected to generate the above free cash flows over the next four years, after which they are expected to grow at a rate of 3% per year. If the weighted average cost of capital is 7% and Conundrum has cash of $80 million, debt of $60 million, and 30 million shares outstanding, what is Choro's expected current share price

Answers: 1

Another question on Business

Business, 21.06.2019 19:30

What would be the input, conversion and output of developing a new soft drink

Answers: 3

Business, 22.06.2019 20:30

Identify the level of the literature hierarchy for u.s. gaap to which each item belongs

Answers: 1

Business, 22.06.2019 20:40

Which one of the following statements is correct? process costing systems use periodic inventory systems. process costing systems assign costs to departments or processes for a time period. companies that produce many different products or services are more likely to use process costing systems. production is continuous when a job-order costing is used to ensure that adequate quantities are on hand.

Answers: 2

Business, 22.06.2019 21:10

Which statement or statements are implied by equilibrium conditions of the loanable funds market? a firm borrowing in the loanable funds market invests those funds with a higher expected return than any firm that is not borrowing. investment projects which use borrowed funds are guaranteed to be profitable even after paying interest expenses. the quantity of savings is maximized, thus the quantity of investment is maximized. a loan is made at the minimum interest rate of all current borrowing.

Answers: 3

You know the right answer?

Choro Mining is expected to generate the above free cash flows over the next four years, after which...

Questions

Chemistry, 02.10.2019 19:30

Chemistry, 02.10.2019 19:30

Chemistry, 02.10.2019 19:30

Physics, 02.10.2019 19:40

Business, 02.10.2019 19:40

History, 02.10.2019 19:40

History, 02.10.2019 19:40

Chemistry, 02.10.2019 19:40

Mathematics, 02.10.2019 19:40

History, 02.10.2019 19:40

Advanced Placement (AP), 02.10.2019 19:40

Mathematics, 02.10.2019 19:40

Social Studies, 02.10.2019 19:40