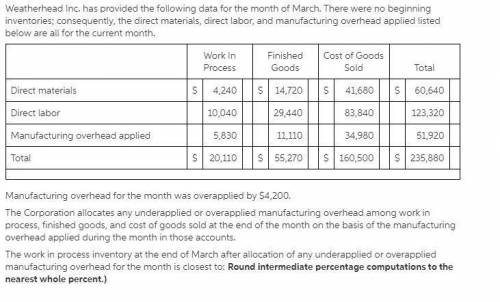

Manufacturing overhead for the month was overapplied by $3,600. The Corporation allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the manufacturing overhead applied during the month in those accounts. The work in process inventory at the end of March after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to: (Round intermediate percentage computations to the nearest whole percent.)

Answers: 3

Another question on Business

Business, 21.06.2019 22:30

What two elements normally must exist before a person can be held liable for a crime

Answers: 1

Business, 22.06.2019 10:40

At cooly cola, we are testing the appeal of our new diet one cola. in a taste test of 250 randomly chosen cola drinkers, 200 consumers preferred diet one cola to the leading brand. assuming that the sample were large enough, the large-sample 95% confidence interval for the population proportion of cola drinkers that prefer diet one cola would be:

Answers: 1

Business, 22.06.2019 13:40

The cook corporation has two divisions--east and west. the divisions have the following revenues and expenses: east west sales $ 603,000 $ 506,000 variable costs 231,000 300,000 traceable fixed costs 151,500 192,000 allocated common corporate costs 128,600 156,000 net operating income (loss) $ 91,900 $ (142,000 ) the management of cook is considering the elimination of the west division. if the west division were eliminated, its traceable fixed costs could be avoided. total common corporate costs would be unaffected by this decision. given these data, the elimination of the west division would result in an overall company net operating income (loss)

Answers: 1

Business, 22.06.2019 18:00

On september 1, 2016, steve loaned brett $2,000 at 12% interest compounded annually. steve is not in the business of lending money. the note stated that principal and interest would be due on august 31, 2018. in 2018, steve received $2,508.80 ($2,000 principal and $508.80 interest). steve uses the cash method of accounting. what amount must steve include in income on his income tax return?

Answers: 1

You know the right answer?

Manufacturing overhead for the month was overapplied by $3,600. The Corporation allocates any undera...

Questions

Biology, 25.09.2019 07:50

Computers and Technology, 25.09.2019 07:50

Social Studies, 25.09.2019 07:50

Social Studies, 25.09.2019 07:50

History, 25.09.2019 07:50

English, 25.09.2019 07:50

Biology, 25.09.2019 07:50

Mathematics, 25.09.2019 08:00

Social Studies, 25.09.2019 08:00

Mathematics, 25.09.2019 08:00

Business, 25.09.2019 08:00

Chemistry, 25.09.2019 08:00