Business, 08.02.2021 23:50 anjlieoutar4795

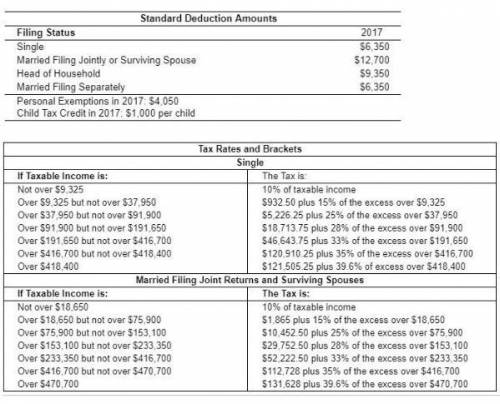

Calculate the 2017 total tax for Gordon Geist, a single taxpayer without dependents and no itemized deductions. He has active income of $44 comma 000, a short-term capital gain income of $2 comma 800 from the sale of stock, and $7600 from book royalties. What is Gordon's average tax rate?

Answers: 3

Another question on Business

Business, 21.06.2019 12:30

Diener and wallbom (1976) found that when research participants were instructed to stop working on a problem after a bell sounded, 71 percent continued working when left alone. how many continued to work after the bell if they were made self-aware by working in front of a mirror?

Answers: 2

Business, 21.06.2019 21:30

An office manager is concerned with declining productivity. despite the fact that she regularly monitors her clerical staff four times each day—at 9: 00 am, 11: 00 am, 1: 00 pm, and again at 3: 00 pm—office productivity has declined 30 percent since she assumed the helm one year ago. would you recommend that the office manager invest more time monitoring the productivity of her clerical staff? explain.

Answers: 3

Business, 22.06.2019 09:50

The returns on the common stock of maynard cosmetic specialties are quite cyclical. in a boom economy, the stock is expected to return 22 percent in comparison to 9 percent in a normal economy and a negative 14 percent in a recessionary period. the probability of a recession is 35 percent while the probability of a boom is 10 percent. what is the standard deviation of the returns on this stock?

Answers: 2

Business, 22.06.2019 13:00

Dakota products has a production budget as follows: may, 16,000 units; june, 19,000 units; and july, 24,000 units. each unit requires 3 pounds of raw material and 2 direct labor hours. dakota desires to keep an inventory of 10% of the next month’s requirements on hand. on may, 1 there were 4,800 pounds of raw material in inventory. direct labor hours required in may would be:

Answers: 1

You know the right answer?

Calculate the 2017 total tax for Gordon Geist, a single taxpayer without dependents and no itemized...

Questions

Biology, 27.01.2021 22:40

Physics, 27.01.2021 22:40

Mathematics, 27.01.2021 22:40

History, 27.01.2021 22:40

Mathematics, 27.01.2021 22:40

Arts, 27.01.2021 22:40

Biology, 27.01.2021 22:40

Mathematics, 27.01.2021 22:40

History, 27.01.2021 22:40

Mathematics, 27.01.2021 22:40

Mathematics, 27.01.2021 22:40

Mathematics, 27.01.2021 22:40

English, 27.01.2021 22:40

Mathematics, 27.01.2021 22:40

Mathematics, 27.01.2021 22:40