Business, 15.02.2021 20:30 maritsaledesma

The weekly time tickets indicate the following distribution of labor hours for three direct labor employees:

Hours

Job 301 Job 302 Job 303 Process Improvement

Tom Couro 10 15 13 2

David Clancy 12 12 14 2

Jose Cano 11 13 15 1

The direct labor rate earned per hour by the three employees is as follows:

Tom Couro $32

David Clancy 36

Jose Cano 28

The process improvement category includes training, quality improvement, and other indirect tasks.

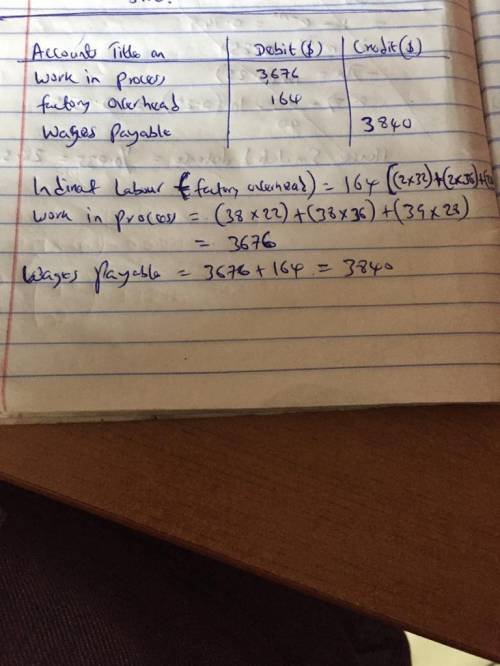

a. Journalize the entry to record the factory labor costs for the week.

b. Assume that Jobs 301 and 302 were completed but not sold during the week and that Job 303 remained incomplete at the end of the week. How would the direct labor costs for all three jobs be reflected on the financial statements at the end of the week?

Answers: 2

Another question on Business

Business, 22.06.2019 06:30

Individual consumers belong to which step of choosing a target market? possible customers competition demographics communication

Answers: 2

Business, 22.06.2019 07:50

Budget in this final week, you will develop a proposed budget of $150,000 for the first year of the program and complete the final concept paper for the proposed program due for senior management review. the budget should identify the program's anticipated expenses for the year ahead. budget line items should be consistent with the proposed program and staffing plan. using the readings for the week, the south university online library, and the internet, complete the following tasks: create a proposed budget of $150,000 for the first year of the proposed program including the cost for personnel, supplies, education materials, marketing costs, and so on in a microsoft excel spreadsheet. you may transfer your budget to your report. justify the cost for each item of the proposed budget in a budget narrative.

Answers: 2

Business, 22.06.2019 11:00

Acoase solution to a problem of externality ensures that a socially efficient outcome is to

Answers: 2

Business, 22.06.2019 13:10

Trey morgan is an employee who is paid monthly. for the month of january of the current year, he earned a total of $4,538. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year, and the fica tax rate for medicare is 1.45% of all earnings for both the employee and the employer. the amount of federal income tax withheld from his earnings was $680.70. his net pay for the month is .

Answers: 1

You know the right answer?

The weekly time tickets indicate the following distribution of labor hours for three direct labor em...

Questions

History, 01.09.2020 21:01

History, 01.09.2020 21:01

Social Studies, 01.09.2020 21:01

History, 01.09.2020 21:01

Business, 01.09.2020 21:01

Mathematics, 01.09.2020 21:01

Business, 01.09.2020 21:01