Business, 16.02.2021 04:20 KariSupreme

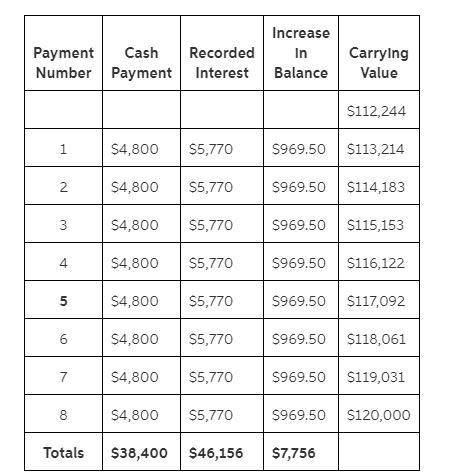

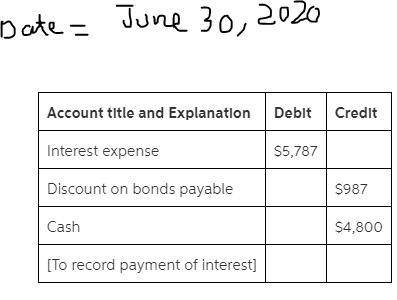

On January 1, 2018, Bradley Recreational Products issued $120,000, 8%, four-year bonds. Interest is paid semiannually on June 30 and December 31. The bonds were issued at $112,244 to yield an annual return of 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate. 2. Prepare an amortization schedule by the straight-line method. 3. Prepare the journal entries to record interest expense on June 30, 2020, by each of the two approaches. 5. Assuming the market rate is still 10%, what price would a second investor pay the first investor on June 30, 2020, for $12,000 of the bonds

Answers: 2

Another question on Business

Business, 21.06.2019 19:20

In 2007, americans smoked 19.2 billion packs of cigarettes. they paid an average retail price of $4.50 per pack. a. given that the elasticity of supply is 0.50.5 and the elasticity of demand is negative 0.4−0.4, derive linear demand and supply curves for cigarettes. the demand equation is qdequals=nothingplus+nothing times ×p and the supply equation is qsequals=nothingplus+nothing times ×p.

Answers: 2

Business, 22.06.2019 00:00

Alandlord rented an art studio to an artist. under the terms of the signed, written, two-year lease, the artist agreed to pay the landlord $1,000 per month and to assume responsibility for all necessary repairs. after the first year of the lease, the artist assigned the balance of his lease to a sculptor. the landlord approved the sculptor as a tenant and accepted two rent payments from her, and then the landlord sold the building to an investor. the sculptor had made two payments to the investor when an electrical fire broke out in the studio, injuring the sculptor. the fire was caused by faulty wiring. the landlord was aware that there was a dangerous wiring problem when he leased the property to the artist. but when the landlord discovered how costly repairs would be, he decided it would be more profitable to sell the property than to repair it. the problem was not easily discoverable by anyone other than an expert electrician, and the landlord did not tell the artist, the sculptor, or the investor about the problem. the sculptor sues to recover damages for her injuries. from whom can the sculptor recover?

Answers: 3

Business, 22.06.2019 06:10

Investment x offers to pay you $5,700 per year for 9 years, whereas investment y offers to pay you $8,300 per year for 5 years. if the discount rate is 6 percent, what is the present value of these cash flows? (do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) present value investment x $ investment y $ if the discount rate is 16 percent, what is the present value of these cash flows? (do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) present value investment x $ investment y

Answers: 1

Business, 22.06.2019 06:40

Burke enterprises is considering a machine costing $30 billion that will result in initial after-tax cash savings of $3.7 billion at the end of the first year, and these savings will grow at a rate of 2 percent per year for 11 years. after 11 years, the company can sell the parts for $5 billion. burke has a target debt/equity ratio of 1.2, a beta of 1.79. you estimate that the return on the market is 7.5% and t-bills are currently yielding 2.5%. burke has two issuances of bonds outstanding. the first has 200,000 bonds trading at 98% of par, with coupons of 5%, face of $1000, and maturity of 5 years. the second has 500,000 bonds trading at par, with coupons of 7.5%, face of $1000, and maturity of 12 years. kate, the ceo, usually applies an adjustment factor to the discount rate of +2 for such highly innovative projects. should the company take on the project?

Answers: 1

You know the right answer?

On January 1, 2018, Bradley Recreational Products issued $120,000, 8%, four-year bonds. Interest is...

Questions

English, 29.06.2019 00:00

Biology, 29.06.2019 00:00

Physics, 29.06.2019 00:00

Mathematics, 29.06.2019 00:10

Computers and Technology, 29.06.2019 00:10

Computers and Technology, 29.06.2019 00:10