Business, 19.02.2021 17:00 alexis3744

The most recent financial statements for Live Co. are shown here:

Income StatementBalance Sheet

Sales$4,800 Current assets$5,102 Debt$10,201

Costs

3,168

Fixed assets12,491 Equity7,392

Taxable income$1,632 Total

$17,593

Total

$17,593

Taxes (34%)555

Net income

$1,077

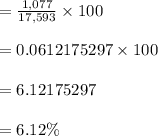

Assets and costs are proportional to sales. Debt and equity are not. The company maintains a constant 30 percent dividend payout ratio. No external equity financing is possible.

Required:

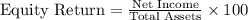

What is the internal growth rate?

A. 4.48%

B. 4.58%

C. 4.38%

D. 11.36%

E. 1.87%

Answers: 2

Another question on Business

Business, 20.06.2019 18:02

Regarding competitive strategies, advertising is used in which strategy? a. global operations b. focused differentiation c. differentiation d. low-cost leadership

Answers: 2

Business, 21.06.2019 16:20

Winston uses the high-low method. it had an average cost per unit of $10 at its lowest level of activity when sales equaled 10,000 units and an average cost per unit of $6.50 at its highest level of activity when sales equaled 20,000 units. what would winston estimate its total cost to be if sales equaled 8,000 units?

Answers: 3

Business, 22.06.2019 14:30

Your own record of all your transactions. a. check register b. account statement

Answers: 1

Business, 22.06.2019 19:40

Aprimary advantage of organizing economic activity within firms is thea. ability to coordinate highly complex tasks to allow for specialized division of labor. b. low administrative costs because of reduced bureaucracy. c. eradication of the principal-agent problem. d. high-powered incentive to work as salaried employees for an existing firm.

Answers: 1

You know the right answer?

The most recent financial statements for Live Co. are shown here:

Income StatementBalance Sheet

Questions

Biology, 31.08.2019 06:00

English, 31.08.2019 06:00

Biology, 31.08.2019 06:00

Physics, 31.08.2019 06:00

History, 31.08.2019 06:00

Mathematics, 31.08.2019 06:00

Mathematics, 31.08.2019 06:00

Biology, 31.08.2019 06:00

Biology, 31.08.2019 06:00