Business, 24.02.2021 01:10 saucyyyyniahhhhh

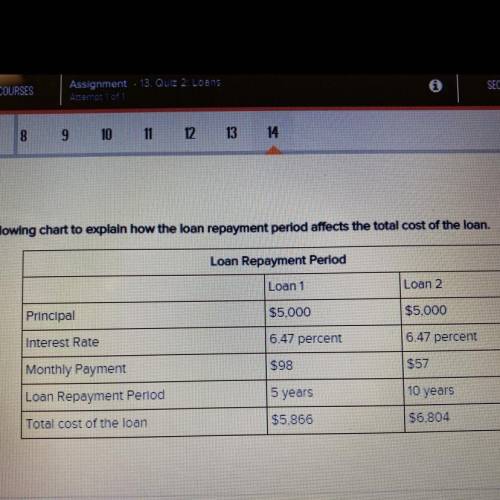

Use the following chart to explain how the loan repayment period affects the total cost of the loan.

Loan Repayment Period

Loan 1

Loan 2

Principal

$5.000

$5.000

Interest Rate

6.47 percent

6.47 percent

$98

$57

Monthly Payment

Loan Repayment Period

5 years

10 years

Total cost of the loan

$5.866

$6.804

Answers: 1

Another question on Business

Business, 22.06.2019 11:50

After graduation, you plan to work for dynamo corporation for 12 years and then start your own business. you expect to save and deposit $7,500 a year for the first 6 years (t = 1 through t = 6) and $15,000 annually for the following 6 years (t = 7 through t = 12). the first deposit will be made a year from today. in addition, your grandfather just gave you a $32,500 graduation gift which you will deposit immediately (t = 0). if the account earns 9% compounded annually, how much will you have when you start your business 12 years from now?

Answers: 1

Business, 23.06.2019 04:40

Which is not true of birthday and/or annual review automatics? a. the purpose is to trigger a telephone call for a face-to-face meeting.b. quarterly automatic contacts decrease cross-sales and lead to reduced referrals.c. you are expected to stay in touch with all your active prospects and clients through two personal contacts each year?

Answers: 1

Business, 23.06.2019 11:40

Anewspaper story on the effect of higher milk prices on the market for ice cream contained the following: "as a result [of the increase in milk prices], retail prices for ice cream are up 4 percent from last year. . and ice cream consumption is down 3 percent." source: john curran, "ice cream, they scream: milk fat costs drive up ice cream prices," associated press, july 23, 2001. based on the information given, what is the price elasticity of demand for ice cream?

Answers: 1

Business, 23.06.2019 15:00

Aplant manager is considering buying additional stamping machines to accommodate increasing demand. the alternatives are to buy 1 machine, 2 machines, or 3 machines. the profits realized under each alternative are a function of whether their bid for a recent defense contract is accepted or not. the payoff table below illustrates the profits realized (in $000's) based on the different scenarios faced by the manager. alternative bid accepted bid rejected buy 1 machine $10 $5 buy 2 machines $30 $4 buy 3 machines $40 $2 refer to the information above. assume that based on historical bids with the defense contractor, the plant manager believes that there is a 65% chance that the bid will be accepted and a 35% chance that the bid will be rejected. what is the expected value under perfect information (evpi)?

Answers: 1

You know the right answer?

Use the following chart to explain how the loan repayment period affects the total cost of the loan....

Questions

Mathematics, 05.10.2019 19:00

Mathematics, 05.10.2019 19:00

Social Studies, 05.10.2019 19:00

Mathematics, 05.10.2019 19:00

History, 05.10.2019 19:00

Mathematics, 05.10.2019 19:00

Mathematics, 05.10.2019 19:00

Mathematics, 05.10.2019 19:00

History, 05.10.2019 19:00

History, 05.10.2019 19:00

Computers and Technology, 05.10.2019 19:00

Social Studies, 05.10.2019 19:00