On January 1, Year 1, Company A (the lessee) entered into an 8-year lease agreement with Company B (the lessor) for industrial equipment. Annual lease payments of $14,378 are payable at the end of each year. Company A's incremental borrowing rate is 7%, and the implicit rate in the lease is 5%, which is known to Company A. On January 1, Year 1, the fair value of the equipment is $125,000 and its estimated useful life is 15 years. Company A depreciates its long-lived assets in accordance with the straight-line depreciation method. At lease commencement date, Company B estimates that the total residual value of the equipment at the end of the lease term will be $47,388. Company A guarantees $40,000 of the residual value of the equipment. However, due to expected high usage of the equipment, Company A estimates that the value of the equipment at the end of the lease term will be only $30,000. Information on present value factors is as follows:

Present value of $1 at 5% for 8 periods0.6768

Present value of $1 at 7% for 8 periods0.5820

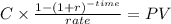

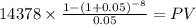

Present value of an annuity of $1 at 5% for 8 periods6.4632

Present value of an annuity of $1 at 7% for 8 periods5.9713

Enter the appropriate amounts in the designated cells. Enter all amounts as positive values. Round all amounts to the nearest whole number. If the amount is zero, enter a zero (0). Enter all percentages as a percentage, not a decimal.

For item 2, select the appropriate lease classification option by Company A from the option list provided.

Item

Amount

1. The discount rate for the lease used by Company A

2. Classification of the lease by Company A

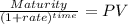

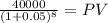

3. The amount at which the lease liability was recognized in Company A's financial statements at the lease commencement date

4. The amount of interest expense recognized by Company A in Year 1

5. The carrying amount of the right-of-use asset in Company A's December 31, Year 1, financial statements

6. The amount of Company A's lease liability on December 31, Year 1, after the first required payment was made

7. The amount of the current portion of the lease liability as it is presented in Company A's December 31, Year 1, financial statements

Answers: 1

Another question on Business

Business, 22.06.2019 05:30

Sally is buying a home and the closing date is set for april 20th. the annual property taxes are $1,234.00 and have not been paid yet. using actual days, how much will the buyer be credited and the seller be debited

Answers: 2

Business, 22.06.2019 16:50

According to ceo heidi ganahl, camp bow wow requires a strong and consistent corporate culture to keep all local franchise owners "on the same page" and to follow a common template for the business and brand. this culture could become detrimental over time because: (a) strong consistent cultures are inflexible and incapable of adapting to environmental change (b) strong consistent cultures are too flexible and capable of adapting to environmental change (c) strong consistent cultures don’t perform well in any environment (d) the passing of time provides stability and predictability for businesses

Answers: 2

Business, 22.06.2019 20:00

Question 6 of 102 pointswhich situation shows a constant rate of change? oa. the number of tickets sold compared with the number of minutesbefore a football gameob. the height of a bird over timeoc. the cost of a bunch of grapes compared with its weightod. the outside temperature compared with the time of day

Answers: 1

Business, 22.06.2019 22:50

Wendy made her career planning timeline in 2010. in what year should wendy's timeline start? a. 2013 o b. 2012 oc. 2010 o d. 2011

Answers: 2

You know the right answer?

On January 1, Year 1, Company A (the lessee) entered into an 8-year lease agreement with Company B (...

Questions

Arts, 18.03.2021 08:30

Mathematics, 18.03.2021 08:30

English, 18.03.2021 08:30

Mathematics, 18.03.2021 08:30

Mathematics, 18.03.2021 08:30

Mathematics, 18.03.2021 08:40

Mathematics, 18.03.2021 08:40

Arts, 18.03.2021 08:40

Mathematics, 18.03.2021 08:40