Business, 01.03.2021 09:30 GreenHerbz206

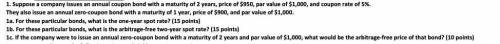

If the company were to issue an annual zero-coupon bond with a maturity of 2 years and par value of $1,000, what would be the arbitrage-free price of that bond?

Answers: 3

Another question on Business

Business, 22.06.2019 11:40

Define the marginal rate of substitution between two goods (x and y). if a consumer’s preferences are given by u(x,y) = x3/4y1/4, compute the consumer’s marginal rate of substitution as a function of x and y. calculate the mrs if the consumer has chosen to consumer 48 units of x and 16 units of y. show your work. (use the back of the page if necessary.

Answers: 3

Business, 22.06.2019 19:30

Nextdoor is an instant messaging application for smartphones. new smartphone users find it easier to connect with friends and relatives through this mobile app when compared to other similar instant messaging applications. hence, it has the largest user base in the industry. thus, nextdoor app's value has increased primarily due to itsa. learning curve effects. b. economies of scale. c. economies of scope. d. network effects.

Answers: 2

Business, 22.06.2019 19:30

Anew firm is developing its business plan. it will require $615,000 of assets, and it projects $450,000 of sales and $355,000 of operating costs for the first year. management is reasonably sure of these numbers because of contracts with its customers and suppliers. it can borrow at a rate of 7.5%, but the bank requires it to have a tie of at least 4.0, and if the tie falls below this level the bank will call in the loan and the firm will go bankrupt. what is the maximum debt ratio the firm can use? (hint: find the maximum dollars of interest, then the debt that produces that interest, and then the related debt ratio.)a. 41.94%b. 44.15%c. 46.47%d. 48.92%e. 51.49%

Answers: 3

Business, 22.06.2019 23:00

Which completes the equation? o + a + consideration (+ = k legal capacity legal capability legal injunction legal corporation

Answers: 1

You know the right answer?

If the company were to issue an annual zero-coupon bond with a maturity of 2 years and par value of...

Questions

Biology, 30.07.2019 07:40

Mathematics, 30.07.2019 07:40

Chemistry, 30.07.2019 07:40

History, 30.07.2019 07:40

Mathematics, 30.07.2019 07:40

English, 30.07.2019 07:40

English, 30.07.2019 07:40

Mathematics, 30.07.2019 07:40

Social Studies, 30.07.2019 07:40

Biology, 30.07.2019 07:40