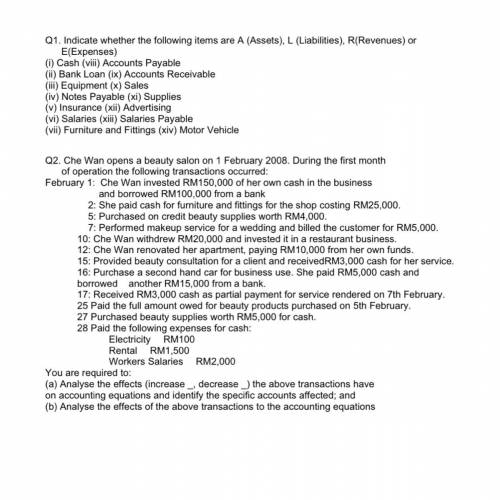

Q1. Indicate whether the following items are A (Assets), L (Liabilities), R(Revenues) or E(Expenses)

(i) Cash

(ii) Bank Loan

(iii) Equipment

(iv) Notes Payable

(v) Insurance

(vi) Salaries

(vii) Furniture and Fittings

(viii) Accounts Payable

(ix) Accounts Receivable

(x) Sales

(xi) Suppliers

(xii) Advertising

(xiii)Salaries Payable

(xiv) Motor Vehicle

Q2. Che Wan opens a beauty salon on 1 February 2008. During the first month of operation the following transactions occurred:

February 1: Che Wan invested RM150,000 of her own cash in the business and borrowed RM100,000 from a bank

2: She paid cash for furniture and fittings for the shop costing RM25,000.

5: Purchased on credit beauty supplies worth RM4,000.

7: Performed makeup service for a wedding and billed the customer for RM5,000.

10: Che Wan withdrew RM20,000 and invested it in a restaurant business.

12: Che Wan renovated her apartment, paying RM10,000 from her own funds.

15: Provided beauty consultation for a client and receivedRM3,000 cash for her service.

16: Purchase a second hand car for business use. She paid RM5,000 cash and borrowed another RM15,000 from a bank.

17: Received RM3,000 cash as partial payment for service rendered on 7th February.

25 Paid the full amount owed for beauty products purchased on 5th February.

27 Purchased beauty supplies worth RM5,000 for cash.

28 Paid the following expenses for cash:

Electricity RM100

Rental RM1,500

Workers Salaries RM2,000

You are required to:

(a) Analyse the effects (increase _, decrease _) the above transactions have on accounting equations and identify the specific accounts affected; and

(b) Analyse the effects of the above transactions to the accounting equations

Answers: 3

Another question on Business

Business, 22.06.2019 15:20

Record the journal entry for the provision for uncollectible accounts under each of the following independent assumptions: a. the allowance for doubtful accounts before adjustment has a credit balance of $500. b. the allowance for doubtful accounts before adjustment has a debit balance of $250. c. assume that octoberʼs credit sales were $70,000. uncollectible accounts expense is estimated at 2% of sales. smith, gaylord n.. excel applications for accounting principles (p. 51). cengage textbook. kindle edition.

Answers: 1

Business, 23.06.2019 02:50

Dakota company experienced the following events during 2016. 1. acquired $30,000 cash from the issue of common stock. 2. paid $12,000 cash to purchase land. 3. borrowed $10,000 cash. 4. provided services for $20,000 cash. 5. paid $1,000 cash for utilities expense. 6. paid $15,000 cash for other operating expenses. 7. paid a $2,000 cash dividend to the stockholders. 8. determined that the market value of the land purchased in event 2 is now $12,700

Answers: 1

Business, 23.06.2019 06:00

If a society decides to produce consumer goods from its available resources, it is answering the basic economic question

Answers: 3

Business, 23.06.2019 07:00

Which of the following are direct employee sources of foodborne disease organisms? a) normal flora b) sick employees c) transient microorganisms d) all of the above

Answers: 1

You know the right answer?

Q1. Indicate whether the following items are A (Assets), L (Liabilities), R(Revenues) or E(Expenses)...

Questions

Mathematics, 06.06.2020 04:58

Social Studies, 06.06.2020 04:58

Mathematics, 06.06.2020 04:58

Mathematics, 06.06.2020 04:58

English, 06.06.2020 04:58

Mathematics, 06.06.2020 04:58

English, 06.06.2020 04:59

Mathematics, 06.06.2020 04:59