Business, 08.03.2021 03:10 zaniyastubbs9

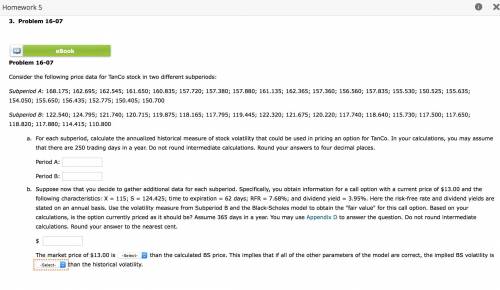

Consider the following price data for TanCo stock in two different subperiods:

Subperiod A: 168.175; 162.695; 162.545; 161.650; 160.835; 157.720; 157.380; 157.880; 161.135; 162.365; 157.360; 156.560; 157.835; 155.530; 150.525; 155.635; 154.050; 155.650; 156.435; 152.775; 150.405; 150.700

Subperiod B: 122.540; 124.795; 121.740; 120.715; 119.875; 118.165; 117.795; 119.445; 122.320; 121.675; 120.220; 117.740; 118.640; 115.730; 117.500; 117.650; 118.820; 117.880; 114.415; 110.800

For each subperiod, calculate the annualized historical measure of stock volatility that could be used in pricing an option for TanCo. In your calculations, you may assume that there are 250 trading days in a year. Do not round intermediate calculations. Round your answers to four decimal places.

Period A:

Period B:

b. Suppose now that you decide to gather additional data for each subperiod. Specifically, you obtain information for a call option with a current price of $13.00 and the following characteristics: X = 115; S = 124.425; time to expiration = 62 days; RFR = 7.68%; and dividend yield = 3.95%. Here the risk-free rate and dividend yields are stated on an annual basis. Use the volatility measure from Subperiod B and the Black-Scholes model to obtain the "fair value" for this call option. Based on your calculations, is the option currently priced as it should be? Assume 365 days in a year. You may use Appendix D to answer the question. Do not round intermediate calculations. Round your answer to the nearest cent.

$

The market price of $13.00 is (Higher/Lower) than the calculated BS price. This implies that if all of the other parameters of the model are correct, the implied BS volatility is (Higher/Lower) than the historical volatility.

Answers: 1

Another question on Business

Business, 21.06.2019 22:30

What two elements normally must exist before a person can be held liable for a crime

Answers: 1

Business, 22.06.2019 09:50

phillips, inc. had the following financial data for the year ended december 31, 2019. cash $ 41,000 cash equivalents 75,000 long term investments 59,000 total current liabilities 149,000 what is the cash ratio as of december 31, 2019, for phillips, inc.? (round your answer to two decimal places.)

Answers: 3

Business, 22.06.2019 16:10

Waterway company’s record of transactions for the month of april was as follows. purchases sales april 1 (balance on hand) 672 @ $6.00 april 3 560 @ $11.00 4 1,680 @ 6.08 9 1,568 @ 11.00 8 896 @ 6.41 11 672 @ 12.00 13 1,344 @ 6.51 23 1,344 @ 12.00 21 784 @ 6.61 27 1,008 @ 13.00 29 560 @ 6.79 5,152 5,936 (a) calculate average-cost per unit. (b) assuming that periodic inventory records are kept in units only, compute the inventory at april 30 using lifo and average-cost. (c) assuming that perpetual inventory records are kept in dollars, determine the inventory using (1) fifo and (2) lifo. (d) compute cost of goods sold assuming periodic inventory procedures and inventory priced at fifo.

Answers: 2

You know the right answer?

Consider the following price data for TanCo stock in two different subperiods:

Subperiod A: 168.175...

Questions

History, 26.02.2021 20:50

Chemistry, 26.02.2021 20:50

Biology, 26.02.2021 20:50

Mathematics, 26.02.2021 20:50

History, 26.02.2021 20:50

Mathematics, 26.02.2021 20:50

Mathematics, 26.02.2021 20:50

Mathematics, 26.02.2021 20:50

Mathematics, 26.02.2021 20:50

History, 26.02.2021 20:50

Mathematics, 26.02.2021 20:50

Mathematics, 26.02.2021 20:50

Mathematics, 26.02.2021 20:50

Computers and Technology, 26.02.2021 20:50