Business, 08.03.2021 20:00 davelopez979

Omni Advisors, an international pension fund manager, uses the concepts of purchasingpower parity (PPP) and uncovered interest parity/international Fisher effect (IFE) toforecast spot exchange rates. Omni gathers the financial information as follows:(Note: The rand (ZAR) is the South African currency. USD refers to the U. S. dollar. The base year denotes the beginning of the period.)

Base price level (any country) 100

Current U. S. price level 105

Current South African price level 111

Base rand spot exchange rate $0.175

Current rand spot exchange rate $0.158

Expected annual U. S. inflation 7%

Expected annual South African inflation 5%

Expected U. S. one-year interest rate 10%

Expected South African one-year interest rate 8%

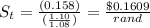

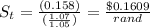

(a) According to PPP, what should the current ZAR spot rate in USD (USD/ZAR)be?

(b) According to PPP, is the U. S. dollar expected to appreciate or depreciate relativeto the rand over the year? Why?

(c) According to the UIP/IFE is the U. S. dollar expected to appreciate or depreciaterelative to the rand over the year? Why?

(d) Compare your answer in b) and c). Are you surprised? Why?

Answers: 3

Another question on Business

Business, 21.06.2019 20:20

On february 3, smart company sold merchandise in the amount of $5,800 to truman company, with credit terms of 2/10, n/30. the cost of the items sold is $4,000. smart uses the perpetual inventory system and the gross method. truman pays the invoice on february 8, and takes the appropriate discount. the journal entry that smart makes on february 8 is:

Answers: 3

Business, 22.06.2019 08:40

Which of the following is not a characteristic of enterprise applications that cause challenges in implementation? a. they introduce "switching costs," making the firm dependent on the vendor. b. they cause integration difficulties as every vendor uses different data and processes. c. they are complex and time consuming to implement. d. they support "best practices" for each business process and function. e. they require sweeping changes to business processes to work with the software.

Answers: 1

Business, 22.06.2019 11:40

You are a manager at asda. you have been given the demand data for the past 10 weeks for swim rings for children. you decide to run multiple types of forecasting methods on the data to see which gives you the best forecast. if you were to use exponential smoothing with alpha =.8, what would be your forecast for week 22? (the forecast for week 21 was 1277.) week demand 12 1317 13 1307 14 1261 15 1258 16 1267 17 1256 18 1268 19 1277 20 1277 21 1297

Answers: 3

Business, 22.06.2019 13:40

The cook corporation has two divisions--east and west. the divisions have the following revenues and expenses: east west sales $ 603,000 $ 506,000 variable costs 231,000 300,000 traceable fixed costs 151,500 192,000 allocated common corporate costs 128,600 156,000 net operating income (loss) $ 91,900 $ (142,000 ) the management of cook is considering the elimination of the west division. if the west division were eliminated, its traceable fixed costs could be avoided. total common corporate costs would be unaffected by this decision. given these data, the elimination of the west division would result in an overall company net operating income (loss)

Answers: 1

You know the right answer?

Omni Advisors, an international pension fund manager, uses the concepts of purchasingpower parity (P...

Questions

Computers and Technology, 21.04.2020 16:34

Mathematics, 21.04.2020 16:34

Mathematics, 21.04.2020 16:34

Social Studies, 21.04.2020 16:34

English, 21.04.2020 16:34

Mathematics, 21.04.2020 16:34

whereas St will be the current level currencies,

whereas St will be the current level currencies,  was its base point currency.

was its base point currency.  would be in the home nation the market price

would be in the home nation the market price  in a different nation was its price standard.

in a different nation was its price standard.

= inflation rate in the home country

= inflation rate in the home country = inflation rate in a foreign country

= inflation rate in a foreign country

= Homeland interest rate

= Homeland interest rate = foreign country interest rate

= foreign country interest rate