Business, 19.03.2021 18:30 niquermonroeee

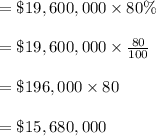

Branch Company, a building materials supplier, has $18,400,000 of notes payable due April 12, 2022. At December 31, 2021, Branch signed an agreement with First Bank to borrow up to $18,400,000 to refinance the notes on a long-term basis. The agreement specified that borrowings would not exceed 70% of the value of the collateral that Branch provided. At the date of issue of the December 31, 2021, financial statements, the value of Branch's collateral was $19,600,000. On its December 31, 2021, balance sheet, Branch should classify the notes as follows:

a. $18,400,000 of long-term liabilities.

b. $18,400,000 of current liabilities.

c. $3,680,000 long-term and $14,720,000 current liabilities.

d. $15,680,000 long-term and $2,720,000 current liabilities.

Answers: 1

Another question on Business

Business, 21.06.2019 16:10

Aldrich and co. sold goods to donovan on credit. the amount owed grew steadily, and finally aldrich refused to sell any more to donovan unless donovan signed a promissory note for the amount due. donovan did not want to but signed the note because he had no money and needed more goods. when aldrich brought an action to enforce the note, donovan claimed that the note was not binding because it had been obtained by economic duress. was he correct? [aldrich & co. v. donovan, 778 p.2d 397 (mont.)]

Answers: 1

Business, 22.06.2019 12:10

Profits from using currency options and futures.on july 2, the two-month futures rate of the mexican peso contained a 2 percent discount (unannualized). there was a call option on pesos with an exercise price that was equal to the spot rate. there was also a put option on pesos with an exercise price equal to the spot rate. the premium on each of these options was 3 percent of the spot rate at that time. on september 2, the option expired. go to the oanda.com website (or any site that has foreign exchange rate quotations) and determine the direct quote of the mexican peso. you exercised the option on this date if it was feasible to do so. a. what was your net profit per unit if you had purchased the call option? b. what was your net profit per unit if you had purchased the put option? c. what was your net profit per unit if you had purchased a futures contract on july 2 that had a settlement date of september 2? d. what was your net profit per unit if you sold a futures contract on july 2 that had a settlement date of september 2

Answers: 1

Business, 22.06.2019 12:50

In june 2009, at the trough of the great recession, the bureau of labor statistics announced that of all adult americans, 140,196,000 were employed, 14,729,000 were unemployed and 80,729,000 were not in the labor force. use this information to calculate: a. the adult population b. the labor force c. the labor-force participation rate d. the unemployment rate

Answers: 3

Business, 22.06.2019 17:40

Take it all away has a cost of equity of 11.11 percent, a pretax cost of debt of 5.36 percent, and a tax rate of 40 percent. the company's capital structure consists of 67 percent debt on a book value basis, but debt is 33 percent of the company's value on a market value basis. what is the company's wacc

Answers: 2

You know the right answer?

Branch Company, a building materials supplier, has $18,400,000 of notes payable due April 12, 2022....

Questions

Mathematics, 06.10.2020 21:01

Mathematics, 06.10.2020 21:01

SAT, 06.10.2020 21:01

English, 06.10.2020 21:01

Mathematics, 06.10.2020 21:01

Computers and Technology, 06.10.2020 21:01

English, 06.10.2020 21:01

Biology, 06.10.2020 21:01

Social Studies, 06.10.2020 21:01

Geography, 06.10.2020 21:01