Business, 19.03.2021 23:10 zdejesus4994

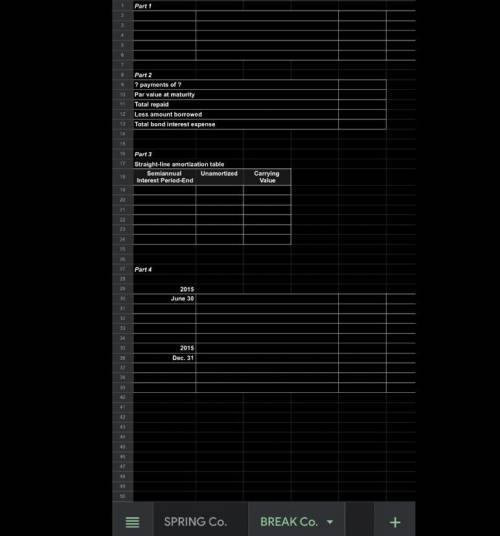

Spring Company issues $725,000 of 4%, four-year bonds dated January 1, 2015, that pay interest semiannually on June 30 and December 31. The market rate is 6% at the issue date. Bonds are sold a 94%

Break Company issues $900,000 of 10%, four-year bonds dated January 1, 2015, that pay interest semiannually on June 30 and December 31. The market rate is 6% at the issue date. Bonds are sold a 114%

Required for EACH company

Prepare the January 1, 2015, journal entry to record the bonds' issuance.

Determine the total bond interest expense to be recognized over the bonds' life.

Prepare a straight-line amortization table for the bonds' first two years.

Prepare the journal entries to record the first two interest payments. m

Answers: 3

Another question on Business

Business, 22.06.2019 06:00

When an interest-bearing note comes due and is uncollectible, the journal entry includes debitingaccounts receivable and crediting notes receivable and interest revenue.accounts receivable and crediting interest revenue.notes receivable and crediting accounts receivable and interest revenue.notes receivable and crediting accounts receivable.

Answers: 3

Business, 23.06.2019 00:40

On june 3, teal company sold to chester company merchandise having a sale price of $2,600 with terms of 2/10, n/60, f.o.b. shipping point. an invoice totaling $91, terms n/30, was received by chester on june 8 from john booth transport service for the freight cost. on june 12, the company received a check for the balance due from chester company. prepare journal entries on the teal company books to record all the events noted above under each of the following bases. (1) sales and receivables are entered at gross selling price. (2) sales and receivables are entered at net of cash discounts.

Answers: 3

Business, 23.06.2019 14:20

Suppose a mutual fund qualifies as having moderate risk if the standard deviation of its monthly rate of return is less than 3%. a mutual-fund rating agency randomly selects 27 months and determines the rate of return for a certain fund. the standard deviation of the rate of return is computed to be 2.19%. is there sufficient evidence to conclude that the fund has moderate risk at the alpha equals 0.05 level of significance? a normal probability plot indicates that the monthly rates of return are normally distributed.

Answers: 2

You know the right answer?

Spring Company issues $725,000 of 4%, four-year bonds dated January 1, 2015, that pay interest semia...

Questions

Mathematics, 04.11.2020 04:40

History, 04.11.2020 04:40

History, 04.11.2020 04:40

History, 04.11.2020 04:40

History, 04.11.2020 04:40

Mathematics, 04.11.2020 04:40

Mathematics, 04.11.2020 04:40

Mathematics, 04.11.2020 04:40

Physics, 04.11.2020 04:40

Mathematics, 04.11.2020 04:40

History, 04.11.2020 04:40