These are the choices fill in the blanks.

asset backed security.

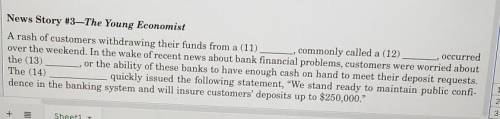

bank run

credit default...

These are the choices fill in the blanks.

asset backed security.

bank run

credit default swap.

capital

bond.

credit

common stock.

credit crunch

mortgage-backed securities.

debt

mutual fund.

default

option.

equity

futures contract.

foreclosure

subprime mortgage.

leverage

central bank.

liquidity

commercial bank.

liquidity risk

hedge fund.

moral hazard

investment bank.

mortgage

fannie mae/ freddie mac.

nationalization

federal deposit insurance corporation.

regulation

federal reserve system.

return

private equity fund

risk

securitization

Answers: 2

Another question on Business

Business, 22.06.2019 08:50

Suppose that in an economy the structural unemployment rate is 2.2 percent, the natural unemployment rate is 5.3 percent, and the cyclical unemployment rate is 2 percent. the frictional unemployment rate is percent and the actual unemployment rate (in this economy) is percent.

Answers: 2

Business, 22.06.2019 09:50

phillips, inc. had the following financial data for the year ended december 31, 2019. cash $ 41,000 cash equivalents 75,000 long term investments 59,000 total current liabilities 149,000 what is the cash ratio as of december 31, 2019, for phillips, inc.? (round your answer to two decimal places.)

Answers: 3

Business, 22.06.2019 13:50

The state troopers in one state have a motto, “nine you’re fine; ten you’re mine,” which is the standard that they use for pulling over speeders on the state highways. in other words, if the posted speed limit is 55 mph, drivers can drive at a rate up to 64 mph without fear of getting a ticket. which of the following best describes the ethical culture in the state? a. the troopers are following a standard of positive law. b. the troopers are following a normative standard. c. the troopers are following a headline test. d. the troopers are following the blanchard/peale standard.

Answers: 1

Business, 22.06.2019 20:20

Xinhong company is considering replacing one of its manufacturing machines. the machine has a book value of $39,000 and a remaining useful life of 5 years, at which time its salvage value will be zero. it has a current market value of $49,000. variable manufacturing costs are $33,300 per year for this machine. information on two alternative replacement machines follows. alternative a alternative b cost $ 115,000 $ 117,000 variable manufacturing costs per year 22,900 10,100 1. calculate the total change in net income if alternative a and b is adopted. 2. should xinhong keep or replace its manufacturing machine

Answers: 1

You know the right answer?

Questions

Mathematics, 29.10.2020 18:00

Mathematics, 29.10.2020 18:00

Mathematics, 29.10.2020 18:00

Arts, 29.10.2020 18:00

Computers and Technology, 29.10.2020 18:00

Health, 29.10.2020 18:00

English, 29.10.2020 18:00

History, 29.10.2020 18:00

Mathematics, 29.10.2020 18:00

Chemistry, 29.10.2020 18:00

Mathematics, 29.10.2020 18:00

English, 29.10.2020 18:00

Mathematics, 29.10.2020 18:00